Crypto’s other halving: Bittensor’s first 4-year cycle seen as ‘maturation’ milestone

Bittensor’s first token halving is scheduled for Dec. 14, reducing TAO issuance by half as the AI-focused network adopts a Bitcoin-style fixed supply model.

Bittensor’s first token halving is scheduled for Dec. 14, reducing TAO issuance by half as the AI-focused network adopts a Bitcoin-style fixed supply model.

Prominent market analyst Michael Van de Poppe has shared four market conditions that would confirm an altcoin market rally. Meanwhile, the cryptocurrency market continues to experience a widespread correction, weighing down the price growth of several assets.

Ethereum has shown more resilience in the last month than Bitcoin, which is largely interpreted as a bullish signal for altcoin enthusiasts. In the last week alone, the prominent altcoin reported a slight market gain of 0.86% compared to Bitcoin’s loss of 1.95%. When Ethereum outperforms Bitcoin, it encourages increased altcoin activity, as investor confidence spreads beyond the market leader into the broader crypto ecosystem.

However, a full altcoin market takeover only comes into effect after the following technical developments. Firstly, de Poppe explains that Bitcoin, as the market leader, must achieve a breakthrough above $92,000 resistance, potentially testing the $100,000 mark, to signal renewed market strength. Additionally, the analyst states the ETH/BTC ratio must stay above its 20-day moving average (MA), indicating Ethereum’s continued dominance and further encouraging altcoin accumulation. Together, these signals could set the technical bedrock for a significant altcoin rally.

Beyond crypto-specific indicators, de Poppe also touches on broader financial market plays that could initiate the next altcoin move. The analyst suggests that a 5-10% correction in gold prices, coupled with a peak in silver, could encourage capital to flow into riskier assets like cryptocurrencies including cryptocurrencies.

Meanwhile, a strong upward movement in the Nasdaq would indicate increased investor risk appetite, a development that often translates into heightened activity in the crypto markets. When combined with positive momentum in Bitcoin and Ethereum, these macro signals could create an environment ripe for a substantial altcoin rally. According to de Poppe, the fulfillment of these conditions indicates that altcoins could achieve market gains of 200%-300% in the present market cycle.

Market OverviewAt the time of writing, the total cryptocurrency market is valued at $3.04 trillion, following a significant 15.5% decline over the past month. Meanwhile, the altcoin market cap stands at $1.26 trillion, accounting for 41.44% of all circulating digital assets. In tandem, data from CoinMarketCap shows the altseason index at 20/100, as Bitcoin still maintains a dominant grip on overall market performance, with a 58.6% dominance.

In short, the conditions for a full-scale altcoin breakout have yet to materialize, but the key indicators highlighted above suggest that scenario may be approaching if momentum shifts decisively toward risk assets.

Покерный мир отметил новое яркое событие: 5 декабря состоялась премьера первого видео на официальном YouTube-канале Марио Мосбека. Профессиональный игрок и амбассадор CoinPoker познакомил зрителей с уникальным материалом, который ранее не попадал ни на одну медиаплатформу. В преддверии премьеры прошел специальный 24-часовой розыгрыш, в ходе которого каждый новый подписчик автоматически участвовал в распределении призов на сумму $5 000. Этот запуск стал заметным шагом вперед в развитии личного бренда Мосбека и предложил поклонникам покера новый источник эксклюзивного контента и аналитики.

Для первого ролика Мосбек подготовил материалы из турнира, который сам по себе вызывает огромный интерес — Triton Invitational Montenegro с бай-ином $200 000. Это одно из самых элитных событий мирового покера, где за столами собираются признанные мастера и известные VIP-игроки. На Дне 1 Марио оказался за столом с Филом Айви, Артуром Мартиросяном, Леоном Штурмом и Джонатаном Джаффе — соперниками, с которыми попадают в одну раздачу лишь лучшие.

Видео включило разбор ключевых моментов турнира, детальные объяснения решений и взгляд изнутри на те раздачи, которые аудитория в обычных условиях никогда бы не увидела. Мосбек не только показал ход игры, но и поделился личными впечатлениями и комментариями о динамике стола. В ролик также вошла его «кулерная» вылетная раздача, ставшая одним из самых эмоциональных моментов сюжета.

За сутки до премьеры CoinPoker и Мосбек организовали акцию, в рамках которой разыгрывали $5 000 среди зрителей, успевших подписаться на канал. Условия были максимально прозрачными: действия требовалось всего одно — нажать кнопку «Подписаться» за сутки до запуска.

В розыгрыше участвовали 200 билетов CoinMasters номиналом по $25, что давало победителям шанс попасть в турнир с гарантией $10 000. Все победители определялись посредством случайной выборки, а тикеты начислялись напрямую на их CoinPoker-аккаунты. Отсутствие скрытых условий и полного контроля случайности сделало акцию привлекательной как для новых пользователей, так и для постоянных поклонников платформы.

Хотя розыгрыш уже завершен, запуск канала ясно продемонстрировал, что это был лишь первый шаг. Канал Мосбека обещает стать регулярным источником аналитики с турниров высоких ставок, образовательных разборов и редких инсайтов, которые могут быть полезны игрокам любого уровня. Поскольку Марио многие годы является частью топовой профессиональной сцены, его контент представляет реальную практическую ценность.

Не менее важно и то, что CoinPoker последовательно внедряет новые активности и промо-кампании. Если ранние подписчики уже получили возможность выиграть билеты CoinMasters, то будущие подписчики также смогут претендовать на новые розыгрыши и бонусы. Чтобы не упускать таких возможностей, достаточно подписаться на канал заранее и следить за обновлениями — это всего один шаг, который легко может превратиться в выгодное участие в следующей акции.

The asset manager’s EPXC fund tokenizes a cash-secured put-writing strategy, signaling deeper integration between traditional market products and blockchain.

Dogecoin has just celebrated its 12th anniversary, a milestone that arrives during a period of shaky price action. The meme coin has spent the majority of recent days trading with a bearish tone, but its anniversary places into perspective how much the crypto environment has changed since the token’s joke-related launch in 2013.

The celebration comes as analysts continue to debate whether Dogecoin’s long accumulation structure is nearing a turning point, and its next breakout might define its 13th year.

Dogecoin began as a lighthearted project by developer Billy Markus and Adobe sales employee Jackson Palmer in order to poke fun at the rising popularity of Bitcoin at the time. Over the years, what started as a joke has grown into one of the world’s most recognized cryptocurrencies.

Happy birthday to Dogecoin.

12 years and going. pic.twitter.com/n9Qg6KtfQU

— dogegod (@_dogegod_) December 6, 2025

At its peak on May 8, 2021, DOGE reached an all-time high of $0.73 with a market capitalization nearing $88.7 billion. Today, despite the recent price action, Dogecoin is still among the top 10 cryptocurrencies, with a market value around $22.5 billion and trading near $0.14.

The 12th birthday of Dogecoin came at a time when broader market sentiment is weak and investors remain cautious. On its anniversary, Dogecoin dropped by 3.1%, steeper than the general market dip, due to ongoing pressure on meme coins.

Amidst this, some milestones still stand out. The introduction of a Spot Dogecoin ETF shows this transformation more vividly than anything else, because it shows major financial players now view the meme coin as an asset worthy of structured, regulated investment exposure.

Although early participation has been modest, the token’s entry into ETF territory is much more symbolic, as it represents a profound departure from the ecosystem that shaped its early years, and this could lead the cryptocurrency to new all-time highs in the coming months.

Reaching 12 years isn’t just a symbolic milestone. It illustrates Dogecoin’s longevity in a crypto environment where many cryptocurrencies fade quickly. The fact that Dogecoin still holds a top-tier market position suggests resilience. That resilience is now being echoed on-chain, as some of the largest Dogecoin wallets have begun adding to their balances again after activity recently fell to a multi-month low.

There are rumors that the updated internal code of Tesla’s website contains deeper Dogecoin payment mechanisms for electric cars like the Model 3 and Cybertruck, which is possibly related to the announced XMoney payment system on the X platform.

This naturally circles back to the influence of Elon Musk, whose support has shaped Dogecoin’s public profile for years. The billionaire has consistently kept Dogecoin in the mainstream conversation through social media posts, product references, and earlier acknowledgments of Dogecoin-related payments for Tesla merchandise.

As for Dogecoin’s price outlook, many analysts are staying bullish. Predictions and price targets for the meme coin range from $0.75, to $1.30, with some pointing to ranges as high as $10.

Featured image from Pexels, chart from TradingView

Crypto venture funding was weak in November, with only a few major raises driving totals, as overall deal activity reached one of its lowest points this year.

The latest market conditions have pushed hopes of an altcoin season even further out of reach. Bitcoin continues to dominate the market with a 59.6% share, and its recent struggle to hold bullish momentum has not translated into any meaningful boost for altcoins.

Broader sentiment has weakened as well, with the CMC Altcoin Season Index registering just 20, which still places the entire market in a Bitcoin-favored phase. Meanwhile, a critical indication has been detected from on-chain data that suggests this may be a rare moment to accumulate strong altcoin positions before conditions eventually turn.

Altcoin performance has really been lagging behind Bitcoin throughout this year, and the persistent weakness is now being reflected across multiple market indicators. Bitcoin’s dominance has only increased, meaning the capital rotation that typically sparks an altcoin season has yet to begin.

The wait for an altcoin breakout has now stretched far longer than many anticipated. Even as the Bitcoin price is struggling, traders have not redirected liquidity toward altcoins. The leading cryptocurrency is now down by 28.9% from its October all-time high of $126,080. Instead, altcoins have also stayed muted, and their combined market cap shows no signs of outperforming the leading cryptocurrency.

Data from CoinMarketCap’s Altcoin Season Index shows the reading is currently at 20. The low reading shows that altcoins are still losing ground relative to Bitcoin. To put this into context, the index was at a reading of 83 this time last year.

The sentiment is also evident in CoinMarketCap’s Fear and Greed Index, which is now at 22. Readings this low signal hesitation across the market, as investors shy away from taking new positions, and this environment makes an altcoin season much harder to materialize.

Technical analysis using data from on-chain analytics platform CryptoQuant shows that altcoin traders may be entering another window that has frequently been favorable for accumulation. The data compares the 30-day trading volume of altcoins against their yearly average and finds that current volumes have slipped back below that long-term line.

Each time this pattern has appeared in past cycles, it marked a period when activity was unusually quiet and traders were hesitant, but it also tended to show up just before the market picked up again.

According to the analysis, this drop in volume can be called a “buying zone,” which is a phase where dollar-cost averaging into selective altcoins has often paid off over time. These low-volume stretches can last for weeks or even months, giving investors enough room to build their positions gradually.

The message from the data is that this calmer part of the cycle may offer one of the better chances to position ahead of the next broader market move.

Featured image from Pexels, chart from TradingView

The long-running question about whether another cryptocurrency can truly match what Bitcoin represents has resurfaced, and Ripple’s Chief Technology Officer David Schwartz has stepped forward to offer his opinion.

His comments were based on an argument claiming that Bitcoin’s properties could be copied by simply recreating its code. This, in turn, was based on comments regarding a debate between Binance founder Changpeng Zhao and Bitcoin critic Peter Schiff.

During their discussion at the Binance Blockchain Week, Schiff stated that a token backed by gold is grounded in physical utility because the token merely represents ownership of a scarce commodity used by industries across the world. He contrasted this with Bitcoin, which he claimed derives its value from faith and has no practical use.

Zhao countered by pointing out that even physical gold is difficult to divide or verify without additional processes, noting that he once received a gold bar as a gift but could not break it or confirm its purity without specialized tools. He contrasted this directly with Bitcoin, which can be transferred and verified instantly through the blockchain.

Again, Schiff responded by insisting that Bitcoin remains worthless to him because you can’t do anything with it, while gold carries intrinsic industrial demand. Zhao pushed back by highlighting that Bitcoin’s utility is tied to its transparent network, fixed supply, and verifiable ownership. He argued that unlike gold, whose total global reserves are uncertain, Bitcoin offers perfect clarity about supply and movement.

The debate eventually escalated into a broader argument over value, with Schiff insisting Bitcoin has only speculative worth, while Zhao maintained that its network and transparency serve as the foundation for its trillion-dollar market capitalization.

“We’ll agree to disagree,” Zhao said.

Following the debate, a viewer commented that Bitcoin’s uniqueness is overstated because someone could simply replicate it. The comment noted, “How long would it take to replicate Bitcoin? Create a new one, exactly the same. How much would it cost?”

It was this claim, rooted in Schiff’s argument that Bitcoin lacks intrinsic qualities, that led to David Schwartz entering the conversation.

Schwartz responded with a rhetorical question that cuts through the idea entirely. He asked how the new Bitcoin could be new and exactly the same as the original one. He continued, “And how would the existence of replicas of Bitcoin affect Bitcoin?”

His point echoed Zhao’s argument about verifiability. A replica may copy Bitcoin’s code, but it cannot copy the network of users, miners, institutions, and real-time validation that give Bitcoin its identity.

The existence of another chain does not dilute Bitcoin’s legitimacy any more than counterfeit gold reduces the value of real gold when proper verification exists. It also goes back to the comment by Changpeng Zhao that Bitcoin can be easily verified in multiple ways, unlike gold.

Featured image from Unsplash, chart from TradingView

Bitcoin saw snap downside toward the weekly close with $87,000 back on the radar ahead of an important Federal Reserve interest-rate decision.

The Bitcoin price continues its descent deep into red territory, as investors increasingly tread the capitulation path. Interestingly, a recent on-chain analysis has been carried out, which dives into the underlying factors that typically control Bitcoin’s December price action.

In a QuickTake post on the CryptoQuant platform, crypto education institution XWIN Research Japan reported that the Coinbase Premium Index metric has recently seen a sharp nosedive. For context, this metric measures the price difference between Bitcoin on the Coinbase (USD) market and Bitcoin on other major global exchanges (such as Binance), or the USDT market. By doing so, it reflects the buying or selling biases of US investors and helps derive insights regarding their behavior.

According to the crypto research institute, the decline started around the late period of November, into early December. Because this decline correlates with an also sharp fall in the Bitcoin price, the apparent sentiment shift among investors from the US appears to be the source of the bearish pressure seen early in the month.

Interestingly, there are historical events that parallel the aforementioned scenario. Typically, December witnesses weaker readings from the Premium when compared to its performance throughout the year. The readings are often near or below zero “largely due to year-end rebalancing and tax-loss harvesting by US institutions and individuals,” XWIN Research highlights.

However, there have been slight deviations from this recurrent pattern. In 2018 and 2022, the Premium saw deep dives into negative zones, as the market was under significant stress in these periods. On another hand, 2020 and 2023 saw positive readings from the Premium, positively correlating with the ongoing bull-market momentum at the time.

XWIN Research Japan, however, made it worthy of note that this year’s scenario has its own “unique twist.” Notably, although the Coinbase Premium began in December with a negative, it has refused to maintain this state. Instead, the analytics platform reports that there was an almost immediate rebound not just into neutral levels, but back into positive territory.

Because this sharp reversal took place within just a few days, it becomes apparent that the Bitcoin market may have seen the last strengths of extant bearish pressure. Interestingly, historical data reveal that such moves as the market has seen often precede price stabilization, or even short-term recoveries. Thus, if history is anything to go by, the Bitcoin price could be close to a local bottom, after which its recovery might follow.

Ultimately, XWIN Research points out that the stabilization, or sustained downturn, of the Bitcoin price depends mostly on “upcoming US capital flows, derivatives positioning, and premium trends.” At press time, Bitcoin holds a valuation of $89,321, with no significant movement since the past day.

The FOMC meeting is scheduled for next Tuesday (December 9-10), and the market is almost unanimous on a dovish stance from the Fed.

Polymarket traders are pricing in a 92% probability of a 25-basis-point cut, which has shifted Bitcoin price analysis from a bearish breakdown to a potential comeback.

Federal Reserve Chair Jerome Powell is expected to proceed with another quarter-point rate reduction this week, even as several policymakers express concern about persistent inflation.

The Fed implemented its second consecutive cut in October, responding to unexpected weakness in the summer jobs data.

Following that decision, hawkish voices emerged among officials, including five current voting members, who indicated reluctance to support further easing in December.

The tide turned on November 21 when New York Fed President John Williams suggested conditions warranted a reduction in the “near term.”

Recent Bitcoin price analysis from Cryptonews highlights a critical on-chain metric gaining momentum.

Bitcoin “liveliness” is climbing again, a pattern that has historically coincided with bull market phases, suggesting the current cycle may have substantial upside remaining.

Analyst Michaël van de Poppe outlined a bullish scenario, anticipating short-term volatility before a sustained rally.

He expects pre-FOMC selling pressure today and Monday, potentially driving prices down to $87,000 to sweep liquidity at the lows.

This would be my bullish scenario.

— Michaël van de Poppe (@CryptoMichNL) December 7, 2025

Pre-FOMC and on Monday, correction to sweep the lows. Perhaps hitting $87K.

After that, bounce back up, swiftly, in which the uptrend is confirmed for #Bitcoin and it's ready to break $92K and therefore the run towards $100K in the coming 1-2… pic.twitter.com/lQezKkQM5W

“After that, bounce back up, swiftly, in which the uptrend is confirmed for Bitcoin and it’s ready to break $92,000

And therefore the run towards $100,000 in the coming 1-2 weeks as the Fed is reducing QT, doing rate cuts and expanding the money supply to increase the business cycle,” van de Poppe stated.

Technical analysis shows Bitcoin breaking out of a long descending red channel, signalling that the strongest phase of the downtrend has likely ended.

Price is currently hovering around the $89,000 zone, which sits just beneath a key resistance-turned-support area highlighted in orange.

Until BTC closes decisively above this zone, sellers can still create short-term pressure.

The breakout attempt already shows early strength, as BTC bounced from the lower channel region near $79,000 and pushed back toward mid-trend.

The next major resistance level is around $94,600, and clearing it would confirm bullish continuation.

If that happens, the chart projects upside targets at $108,000 and eventually $116,000, which align with previous liquidity zones.

As Bitcoin positions for a potential comeback driven by Fed rate cuts, presale projects like Maxi Doge (MAXI) are attracting investor attention.

MAXI is capturing the grassroots momentum that drove Dogecoin’s extraordinary 161,000x rally.

The project has secured over $4.2 million in funding while building an active community focused on sharing trading strategies and market opportunities.

Notably, 25% of capital raised will be invested in promising plays, with returns recycled into marketing initiatives and community rewards to accelerate growth.

Investors can join the presale at $0.000272 by visiting the official Maxi Doge website.

Then connect an Ethereum-compatible wallet like Best Wallet, and purchase MAXI with ETH, BNB, or USDT.

Bank card payments are also supported for instant access.

The post Bitcoin Price Analysis: 92% Fed Rate Cut Probability Sparks Bitcoin Comeback Talk appeared first on Cryptonews.

Bitcoin’s (BTC) ongoing price correction has been accompanied by several other negative developments that continue to grab investors’ attention. Most recently, market analyst Darkfost has observed a significant crash in Bitcoin spot trading volume, while highlighting potential long-term implications of such an event.

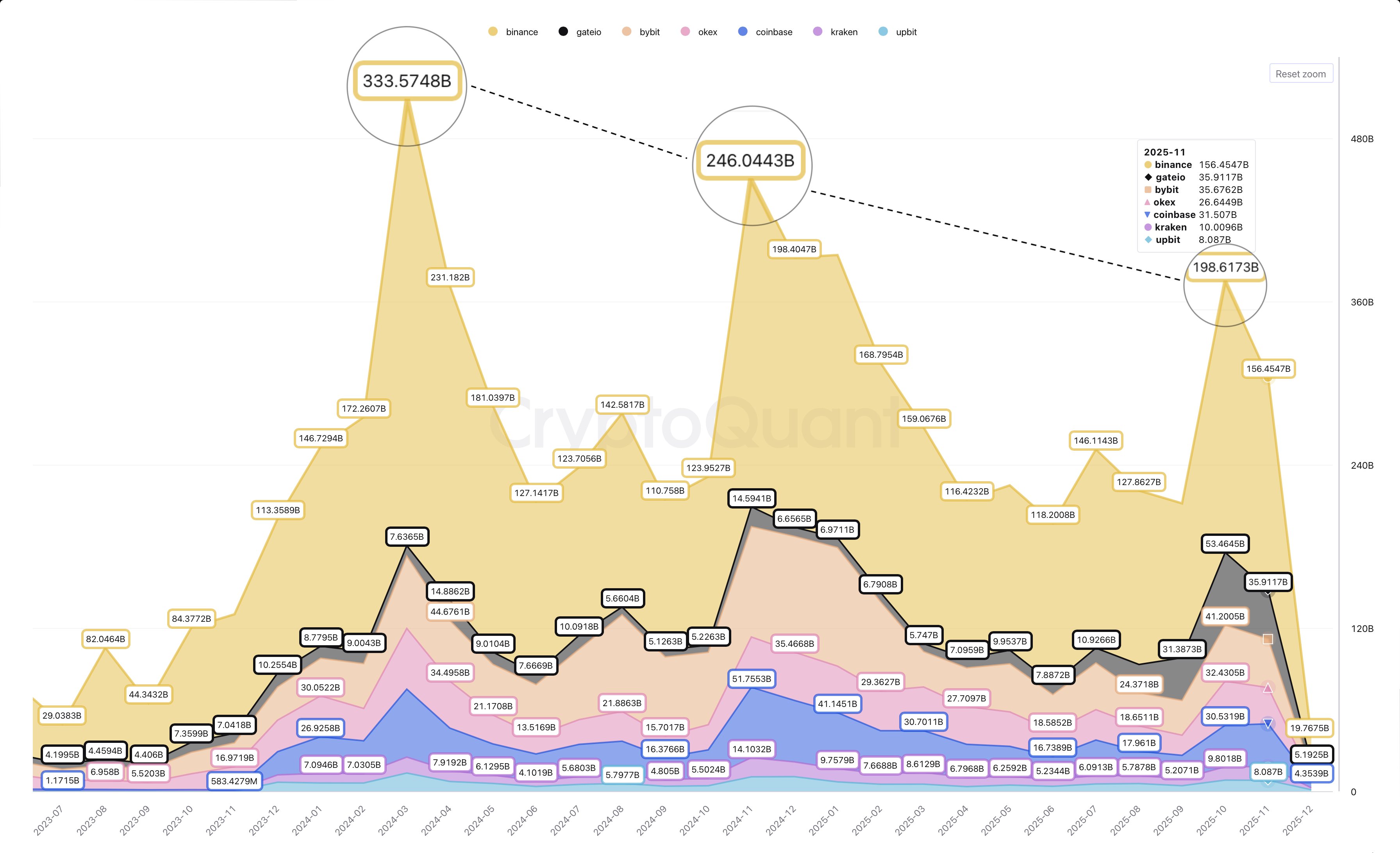

The spot trading volume refers to the total amount of Bitcoin that is bought and sold for immediate delivery on exchanges within a specific time period. It is a key market indicator used to gauge participation, liquidity, and investor interest. According to Darkfost in an X post on December 6, the Bitcoin market, in November, experienced a major fall in spot trading volume across major crypto exchanges. This development has been attributed to the asset’s price struggles, wherein it recorded a 17.5% devaluation during this period.

On Binance, which accounts for more than half of all Bitcoin spot trading activity, spot volume fell from $198 billion in October to $156 billion in November, representing a 21% decline. The downturn was mirrored across other major exchanges, with ByBit posting a 13.5% drop, Gate.io sliding 33%, and OKX down 18%.

Interestingly, Darkfost explains that Bitcoin’s recent price action, the major negative catalyst, pales in comparison to previous corrections. However, another red reading in December could initiate a market deterioration marked by conditions such as continued selling pressure, low market confidence, and, importantly, further drops in spot activity.

A continuous decline in spot trading volume primarily mirrors a lack of market interest and is accompanied by other concerning factors, such as a weaker demand, high vulnerability to price swings, and limited support for rallies as investors prefer to sit on the sidelines. This dynamic, in turn, weighs on price growth, creating a self-reinforcing bearish loop.

In related news, Darkfost also reports that the present market cycle has featured a consistent decline in spot trading volume peaks. Notably, the chart above shows a market high of $333.57 billion on Binance in March 2024, followed by the lower peak of $246.04 billion in November 2024, and then just $198.6 billion last October.

This trend becomes even more concerning when looking at the spot-to-futures volume ratio, which currently sits at 0.23, meaning futures activity now accounts for more than 75% of overall trading. In essence, while the Bitcoin market remains active, investor enthusiasm on the spot side is fading. By contrast, traders appear increasingly willing to speculate in the futures market, likely driven by elevated uncertainty and short-term volatility.

At press time, Bitcoin trades at $89,300, reflecting a 0.21% loss in the past day.

American multinational financial services company Western Union has unveiled a stablecoin strategy to expand its digital business and cross-border remittances. In particular, the money transfer firm is looking to launch a stablecoin card service targeted at nations with high inflation rates.

Matthew Cagwin, chief financial officer and executive vice-president at Western Union, has shared various ideas the financial service giant holds around the adoption and potential offerings of stablecoins. These revelations were made in a presentation at the UBS Global Technology and AI conference on December 2, 2025.

Notably, Cagwin acknowledges that Western Union views stablecoins as a significant opportunity to free the company’s cash flow for other purposes. Due to the instantaneous and predictable nature of these cryptocurrencies, the executive outlines a business model in which Western Union can settle transactions immediately, without needing to hold hundreds of millions of dollars for liquidity, as is typical in the traditional financial system.

Notably, Western Union also aims to offer a “stable card”, modeled on the prepaid card in the US but targeted at users in nations with high inflationary pressure. Cagwin explained the need for this product, referencing Argentina as an example.

The CFO said:

… If you’re — I have a big workforce in Argentina. Can you imagine living in a country where last year, your inflation was 250%, 300%. We gave our employees 4 raises last year because if you didn’t, they made — they couldn’t afford their bills. So imagine a world where your family in the U.S. is sending you $500 home, but by the time you spend it in the next month, it’s only worth $300. So we can see a good utility for our stable card there,…

Cagwin also explains Western Union’s ongoing efforts to establish a digital asset network (DAN). Notably, the financial services firm has established partnerships with four service providers with the intent to offer on-ramp and off-ramp services to users from H1 2026, using the yellow wallets and agents, such as a big box store or check casher.

In addition to the stable card, Cagwin states that Western Union plans to launch a stablecoin, which they believe will scale easily, considering their present business network. In opting against onboarding existing stablecoins, Cagwin explains the firm’s goal of maintaining end-to-end of the proposed coin’s use, economics, and distribution operation.

At press time, the total crypto market cap is valued at $3.05 trillion, after a 0.37% gain in the last day. Meanwhile, total stablecoins are valued at $317.63 billion, representing 10% of circulating digital assets.

Bitcoin Cash has outpaced every major L1 in 2025, boosted by clean supply dynamics and renewed investor demand.

A key on-chain indicator known as Bitcoin “liveliness” is climbing again, a pattern historically associated with bull market activity, raising the possibility that the current cycle still has room to run, according to analysts tracking long-term blockchain metrics.

Key Takeaways:

Technical analyst TXMC said on Sunday that liveliness has been “marching higher despite lower prices,” a divergence that suggests steady underlying demand for spot Bitcoin even as market sentiment remains subdued.

The metric, described as an “elegant” long-term gauge of chain activity, measures the ratio of coins being transacted relative to those being held, weighted by their age.

It increases when older coins are spent more frequently, and falls when long-term holders accumulate.

“Liveliness usually rises in bull runs as supply changes hands at higher prices, indicating a flow of newly invested capital,” TXMC explained, noting that the latest upward trend contradicts the muted price action seen in recent weeks.

Glassnode data shows liveliness pushing into a new peak range, breaking out of the corridor it remained stuck in from the 2017 all-time-high through earlier cycles.

Analyst James Check said the current spike in liveliness reflects an unprecedented reactivation of dormant Bitcoin supply, surpassing patterns seen during the 2017 bull run, the first cycle characterized by “widespread participation” and a dramatic parabolic surge.

Liveliness has been range bound since the 2017 peak, up until now.

— _Checkmate

The 2017 Bull was special in that it was the first epic parabola with widespread participation, but was also when many old coins transacted to capture the BCH dividend.

New Liveliness ATHs shows how extreme the… https://t.co/aoVFr2jOsR(@_Checkmatey_) December 6, 2025

This time, however, the scale is far larger. While 2017 typically saw transfers measured in the thousands of dollars, Check noted that today’s on-chain value flows often reach into the billions, signaling one of the largest capital rotations Bitcoin has experienced.

“We have seen an extraordinary volume of coin days destroyed,” Check said. “I am of the view we have just watched one of the greatest capital rotations and changing of the guard in Bitcoin history.”

Bitcoin’s price action remains subdued despite the on-chain strength. BTC briefly dipped below $89,000 early Sunday before recovering to around $89,500, largely unchanged over 24 hours.

Analyst Michaël van de Poppe said the market is stuck in a consolidation band: “Anything between $86,000 and $92,000 is pretty much noise.”

Anything between $86-92K is pretty much noise. Not much will happen for $BTC.

— Michaël van de Poppe (@CryptoMichNL) December 6, 2025

If $92K gets tested, I think we'll break it, but if not, brace yourself for a test at the low $80K range for some sort of double-bottom pattern.

Again, I don't think we're far off bottoming for… pic.twitter.com/6acTFBAZk4

He added that a test of $92,000 could lead to a breakout, while failure could push BTC toward the low $80,000s for a potential double-bottom formation.

“I don’t think we’re far off bottoming for Bitcoin,” van de Poppe said, predicting a stronger rally heading into late Q4 and early Q1.

Last week, Bitfinex said the market is showing “seller exhaustion” following a period of heavy deleveraging and panic-driven exits by short-term holders.

“The combination of extreme deleveraging, capitulation among short-term holders, and early signs of seller exhaustion has created the conditions for a stabilisation phase and a relief bounce,” the firm wrote.

The post Bitcoin “Liveliness” Indicator Rises, Hinting the Bull Cycle May Not Be Over appeared first on Cryptonews.

Ether held on centralized exchanges has fallen to its lowest level in history, fueling speculation that a supply squeeze may be forming beneath the surface of the market.

Key Takeaways:

According to Glassnode, exchange balances dropped to 8.7% of total ETH supply last Thursday, the smallest share recorded since Ethereum’s launch in 2015. Levels remained near that low at 8.8% on Sunday.

The sharp decline represents a 43% drop in ETH exchange balances since early July, coinciding with the acceleration of digital asset treasury (DAT) purchases and growing activity across the broader Ethereum ecosystem.

Macro research outlet Milk Road said ETH is “quietly entering its tightest supply environment ever,” noting that Bitcoin’s exchange balance remains significantly higher at 14.7%.

Analysts attributed the shift to structural changes in how ETH is being used. More tokens are flowing into staking, restaking protocols, layer-2 networks, DAT balance sheets, collateralized DeFi positions, and long-term self-custody, destinations that historically do not circulate supply back onto exchanges.

“Sentiment feels heavy right now, but sentiment doesn’t dictate supply,” Milk Road wrote. “When that gap closes, price follows.”

Beyond supply metrics, market technicians are spotting signals that buyers may be gaining control. Analyst Sykodelic highlighted an On-Balance Volume (OBV) breakout above resistance late last week, even as price failed to follow.

$ETH is quietly entering its tightest supply environment ever.

— Milk Road (@MilkRoad) December 5, 2025

Exchange balances just fell to 8.84% of total supply, a level we’ve never seen before.

For context, $BTC is still sitting near 14.8%.

ETH keeps getting pulled into places that don’t sell, staking, restaking, L2… pic.twitter.com/T7MW3D2bG1

The divergence, they said, is a classic sign of “hidden buying strength” that sometimes precedes upward moves.

“This is a sign of buying strength, and typically, the price will follow,” the analyst noted, while cautioning that indicators aren’t guarantees.

They added that overall price action “looks bullish,” suggesting ETH may revisit higher levels before any meaningful retracement.

Ether has held above the $3,000 mark for nearly a week but continues to face resistance near $3,200. Over the past 24 hours, ETH has consolidated around $3,050, mirroring the broader market’s indecision.

The ETH/BTC pair also drew attention last week after breaking above a long-standing downtrend, a move some traders see as an early sign of capital rotating back into Ethereum.

Meanwhile, BitMine Immersion Technologies, already the largest corporate holder of Ether, has continued aggressively buying the dip even as top traders position for further declines.

The firm purchased another $199 million in ETH over the past two days, adding to its rapidly expanding reserves.

BitMine now controls $11.3 billion worth of Ether, roughly 3.08% of the total supply, and is closing in on its long-stated goal of reaching 5%.

Last month, Tom Lee said Ether may be entering the early stages of the type of explosive growth cycle that propelled Bitcoin to a 100x rally since 2017.

Lee said the current Ether market resembles Bitcoin’s setup eight years ago, a period marked by deep volatility that ultimately preceded one of the strongest bull cycles in crypto history.

The post Ether Supply on Exchanges Falls to Record Low, Raising Supply Squeeze Hopes appeared first on Cryptonews.

South Korea is moving to impose bank-level liability standards on crypto exchanges following a $30.1 million hack at Upbit last month, shifting toward treating major platforms with the same regulatory rigor as traditional financial institutions.

According to The Korea Times, the Financial Services Commission is reviewing provisions that would require crypto exchanges to compensate users for losses caused by hacking or system failures, regardless of fault, mirroring rules currently applied only to banks and electronic payment firms under the country’s electronic financial transactions law.

The push follows a Nov. 27 breach at Upbit that saw over 104 billion Solana-based tokens worth 44.5 billion won ($36M) transferred to external wallets in just 54 minutes.

Despite the incident, the exchange faced minimal penalties since regulators cannot order compensation under existing laws.

— Cryptonews.com (@cryptonews) November 27, 2025

South Korea’s largest crypto exchange Upbit @Official_Upbit reported a $36m Solana network hack on Thursday, halting withdrawals on the spot and pledging to fully reimburse affected customers.

The incident comes on the same date as its 2019 breach l…https://t.co/o0VLiqKin7

The planned reforms come amid a pattern of platform instability across Korea’s crypto sector.

Financial Supervisory Service data shows the five major exchanges, Upbit, Bithumb, Coinone, Korbit, and Gopax, recorded 20 system failures between 2023 and September this year, affecting over 900 users with combined losses of 5 billion won.

Upbit alone accounted for six incidents, with more than 600 victims suffering 3 billion won in damages.

Draft legislation is expected to mandate IT security infrastructure plans, upgraded system standards, and significantly stronger penalties.

Lawmakers are considering revisions that would allow fines of up to 3 percent of annual revenue for hacking incidents, matching standards for traditional financial institutions and replacing the current 5 billion won cap.

The shift would fundamentally reshape accountability in Korea’s crypto industry by making exchanges liable to compensate victims, as banks must respond to security breaches or system failures.

The Upbit breach also exposed reporting failures, with the exchange waiting over six hours after detecting the hack at 5 a.m. to notify regulators at 10:58 a.m.

Ruling party lawmakers alleged that Dunamu deliberately delayed disclosure until after its scheduled merger with Naver Financial, which concluded at 10:50 a.m.

The regulatory tightening extends beyond security requirements into comprehensive anti-money laundering enforcement.

Korea’s Financial Intelligence Unit is preparing sanctions against major exchanges following on-site inspections that examined compliance with Know Your Customer checks and suspicious transaction reporting.

The unit has already disciplined Dunamu with a three-month suspension on new customer activity and a 35.2 billion won fine, setting a precedent for penalties expected to reach hundreds of billions of won across the sector.

Authorities are simultaneously expanding the crypto travel rule to apply to transactions under 1 million won, closing a loophole that allowed users to evade identity checks by splitting transfers into smaller amounts.

“We will crack down on crypto money laundering, expanding the Travel Rule to transactions under 1 million won,” Financial Services Commission Chairman Lee Eok-won said during a National Assembly briefing.

The Financial Intelligence Unit will gain pre-emptive account-freezing powers in serious cases, while new rules will bar individuals with convictions for tax crimes or drug offenses from becoming major shareholders in licensed platforms.

Legislative amendments are expected in the first half of 2026 as Korea aligns with global standards through expanded coordination with the Financial Action Task Force.

— Cryptonews.com (@cryptonews) November 18, 2025

South Korean crypto tax may face a fourth delay to 2027 as proposed amendments fail to address framework issues. #CryptoTax #SouthKoreahttps://t.co/L0vuIlvbSu

The enforcement drive unfolds as Korea’s long-delayed crypto tax regime faces potential postponement beyond its January 2027 start date due to persistent infrastructure gaps, with no significant updates to the framework despite multiple deferrals since its 2020 approval.

Recently, lawmakers also set a December 10 deadline for the government to deliver a stablecoin regulatory framework, or face legislative action, with debates centering on whether banks should lead issuance or whether fintech firms should participate more actively.

Financial Supervisory Service Gov. Lee Chan-jin acknowledged the limits of current oversight despite the seriousness of the Upbit incident, stating that “regulatory oversight clearly has limits in imposing penalties” under existing law.

However, with the planned reforms, it aims to close these gaps as Korea positions itself to compete with major economies that have already formalized comprehensive digital asset frameworks.

The post Korea to Treat Crypto Exchanges Like Banks After Upbit Hack appeared first on Cryptonews.

The euro stablecoin market has staged a sharp rebound in the year since the EU’s Markets in Crypto-Assets Regulation (MiCA) took effect, doubling in size as new rules for issuers came online.

Key Takeaways:

According to Decta’s Euro Stablecoin Trends Report 2025, the sector’s market capitalization has surged from last year’s slump, reversing a 48% contraction and outpacing the broader stablecoin market’s 26% growth rate.

Decta’s report says euro-denominated stablecoins climbed to roughly $500 million by May 2025 following MiCA’s June 2024 rollout, a shift credited to clearer issuer obligations and standardized reserve rules.

Today, the market sits at around $680 million, per CoinGecko. However, the market is still tiny compared with the nearly $300 billion locked in US dollar-backed tokens, a space dominated by USDT and USDC.

Much of the growth came from a handful of standout issuers. Stasis’ EURS posted the strongest expansion, soaring 644% to $283.9 million as of October 2025.

Circle’s EURC and Societe Generale’s EURCV also saw meaningful increases as regulated issuers began to capitalize on MiCA’s clarity around custody, reserves and public disclosures.

Activity on-chain grew alongside market cap. Monthly transaction volume for euro stablecoins jumped nearly ninefold to $3.83 billion after MiCA implementation, the report found.

JUST IN:

— Futures (@FuturesDotNYC) December 3, 2025Ten European banks are building a euro stablecoin under Dutch Central Bank oversight.

They’re targeting regulatory approval in late 2026 pic.twitter.com/8zZv4d8Q5t

EURC and EURCV led the surge, with volumes climbing 1,139% and 343%, supported by greater use in cross-border payments, fiat on-ramps and crypto trading pairs, areas previously dominated by dollar stablecoins.

The regulatory shift also appears to be stimulating public interest. Decta recorded sharp spikes in search activity across EU markets, including a 400% jump in Finland and more than tripling in Italy.

Interest rose across smaller economies as well, suggesting broader consumer awareness as euro-denominated tokens begin carving out a clearer role in Europe’s digital-asset landscape.

As reported, Poland’s push to bring its crypto sector in line with the EU’s MiCA framework collapsed after lawmakers failed to overturn President Karol Nawrocki’s veto of a major digital-asset bill.

The vote fell short of the required three-fifths majority, leaving Poland as the only EU member without a national MiCA-style regulatory regime and forcing the government to restart the legislative process.

Prime Minister Donald Tusk had argued that the bill was necessary for national security, warning that unregulated crypto activity had become a channel for money laundering and foreign interference, including covert financing linked to Russia and Belarus.

Authorities have connected these concerns to several recent security incidents, including alleged sabotage plots in Poland reportedly funded through cryptocurrencies.

The veto has intensified political tensions between Nawrocki and Tusk’s pro-EU coalition.

The president rejected the bill on grounds that it overreached EU requirements and posed risks to civil liberties and property rights.

The post Euro Stablecoin Market Doubles to $680M A Year After MiCA appeared first on Cryptonews.