How Wellness Influencers Spreading Misinformation Signals a Deeper Problem Within Our Health Care System

A key on-chain indicator known as Bitcoin “liveliness” is climbing again, a pattern historically associated with bull market activity, raising the possibility that the current cycle still has room to run, according to analysts tracking long-term blockchain metrics.

Key Takeaways:

Technical analyst TXMC said on Sunday that liveliness has been “marching higher despite lower prices,” a divergence that suggests steady underlying demand for spot Bitcoin even as market sentiment remains subdued.

The metric, described as an “elegant” long-term gauge of chain activity, measures the ratio of coins being transacted relative to those being held, weighted by their age.

It increases when older coins are spent more frequently, and falls when long-term holders accumulate.

“Liveliness usually rises in bull runs as supply changes hands at higher prices, indicating a flow of newly invested capital,” TXMC explained, noting that the latest upward trend contradicts the muted price action seen in recent weeks.

Glassnode data shows liveliness pushing into a new peak range, breaking out of the corridor it remained stuck in from the 2017 all-time-high through earlier cycles.

Analyst James Check said the current spike in liveliness reflects an unprecedented reactivation of dormant Bitcoin supply, surpassing patterns seen during the 2017 bull run, the first cycle characterized by “widespread participation” and a dramatic parabolic surge.

Liveliness has been range bound since the 2017 peak, up until now.

— _Checkmate

The 2017 Bull was special in that it was the first epic parabola with widespread participation, but was also when many old coins transacted to capture the BCH dividend.

New Liveliness ATHs shows how extreme the… https://t.co/aoVFr2jOsR(@_Checkmatey_) December 6, 2025

This time, however, the scale is far larger. While 2017 typically saw transfers measured in the thousands of dollars, Check noted that today’s on-chain value flows often reach into the billions, signaling one of the largest capital rotations Bitcoin has experienced.

“We have seen an extraordinary volume of coin days destroyed,” Check said. “I am of the view we have just watched one of the greatest capital rotations and changing of the guard in Bitcoin history.”

Bitcoin’s price action remains subdued despite the on-chain strength. BTC briefly dipped below $89,000 early Sunday before recovering to around $89,500, largely unchanged over 24 hours.

Analyst Michaël van de Poppe said the market is stuck in a consolidation band: “Anything between $86,000 and $92,000 is pretty much noise.”

Anything between $86-92K is pretty much noise. Not much will happen for $BTC.

— Michaël van de Poppe (@CryptoMichNL) December 6, 2025

If $92K gets tested, I think we'll break it, but if not, brace yourself for a test at the low $80K range for some sort of double-bottom pattern.

Again, I don't think we're far off bottoming for… pic.twitter.com/6acTFBAZk4

He added that a test of $92,000 could lead to a breakout, while failure could push BTC toward the low $80,000s for a potential double-bottom formation.

“I don’t think we’re far off bottoming for Bitcoin,” van de Poppe said, predicting a stronger rally heading into late Q4 and early Q1.

Last week, Bitfinex said the market is showing “seller exhaustion” following a period of heavy deleveraging and panic-driven exits by short-term holders.

“The combination of extreme deleveraging, capitulation among short-term holders, and early signs of seller exhaustion has created the conditions for a stabilisation phase and a relief bounce,” the firm wrote.

The post Bitcoin “Liveliness” Indicator Rises, Hinting the Bull Cycle May Not Be Over appeared first on Cryptonews.

Ether held on centralized exchanges has fallen to its lowest level in history, fueling speculation that a supply squeeze may be forming beneath the surface of the market.

Key Takeaways:

According to Glassnode, exchange balances dropped to 8.7% of total ETH supply last Thursday, the smallest share recorded since Ethereum’s launch in 2015. Levels remained near that low at 8.8% on Sunday.

The sharp decline represents a 43% drop in ETH exchange balances since early July, coinciding with the acceleration of digital asset treasury (DAT) purchases and growing activity across the broader Ethereum ecosystem.

Macro research outlet Milk Road said ETH is “quietly entering its tightest supply environment ever,” noting that Bitcoin’s exchange balance remains significantly higher at 14.7%.

Analysts attributed the shift to structural changes in how ETH is being used. More tokens are flowing into staking, restaking protocols, layer-2 networks, DAT balance sheets, collateralized DeFi positions, and long-term self-custody, destinations that historically do not circulate supply back onto exchanges.

“Sentiment feels heavy right now, but sentiment doesn’t dictate supply,” Milk Road wrote. “When that gap closes, price follows.”

Beyond supply metrics, market technicians are spotting signals that buyers may be gaining control. Analyst Sykodelic highlighted an On-Balance Volume (OBV) breakout above resistance late last week, even as price failed to follow.

$ETH is quietly entering its tightest supply environment ever.

— Milk Road (@MilkRoad) December 5, 2025

Exchange balances just fell to 8.84% of total supply, a level we’ve never seen before.

For context, $BTC is still sitting near 14.8%.

ETH keeps getting pulled into places that don’t sell, staking, restaking, L2… pic.twitter.com/T7MW3D2bG1

The divergence, they said, is a classic sign of “hidden buying strength” that sometimes precedes upward moves.

“This is a sign of buying strength, and typically, the price will follow,” the analyst noted, while cautioning that indicators aren’t guarantees.

They added that overall price action “looks bullish,” suggesting ETH may revisit higher levels before any meaningful retracement.

Ether has held above the $3,000 mark for nearly a week but continues to face resistance near $3,200. Over the past 24 hours, ETH has consolidated around $3,050, mirroring the broader market’s indecision.

The ETH/BTC pair also drew attention last week after breaking above a long-standing downtrend, a move some traders see as an early sign of capital rotating back into Ethereum.

Meanwhile, BitMine Immersion Technologies, already the largest corporate holder of Ether, has continued aggressively buying the dip even as top traders position for further declines.

The firm purchased another $199 million in ETH over the past two days, adding to its rapidly expanding reserves.

BitMine now controls $11.3 billion worth of Ether, roughly 3.08% of the total supply, and is closing in on its long-stated goal of reaching 5%.

Last month, Tom Lee said Ether may be entering the early stages of the type of explosive growth cycle that propelled Bitcoin to a 100x rally since 2017.

Lee said the current Ether market resembles Bitcoin’s setup eight years ago, a period marked by deep volatility that ultimately preceded one of the strongest bull cycles in crypto history.

The post Ether Supply on Exchanges Falls to Record Low, Raising Supply Squeeze Hopes appeared first on Cryptonews.

South Korea is moving to impose bank-level liability standards on crypto exchanges following a $30.1 million hack at Upbit last month, shifting toward treating major platforms with the same regulatory rigor as traditional financial institutions.

According to The Korea Times, the Financial Services Commission is reviewing provisions that would require crypto exchanges to compensate users for losses caused by hacking or system failures, regardless of fault, mirroring rules currently applied only to banks and electronic payment firms under the country’s electronic financial transactions law.

The push follows a Nov. 27 breach at Upbit that saw over 104 billion Solana-based tokens worth 44.5 billion won ($36M) transferred to external wallets in just 54 minutes.

Despite the incident, the exchange faced minimal penalties since regulators cannot order compensation under existing laws.

— Cryptonews.com (@cryptonews) November 27, 2025

South Korea’s largest crypto exchange Upbit @Official_Upbit reported a $36m Solana network hack on Thursday, halting withdrawals on the spot and pledging to fully reimburse affected customers.

The incident comes on the same date as its 2019 breach l…https://t.co/o0VLiqKin7

The planned reforms come amid a pattern of platform instability across Korea’s crypto sector.

Financial Supervisory Service data shows the five major exchanges, Upbit, Bithumb, Coinone, Korbit, and Gopax, recorded 20 system failures between 2023 and September this year, affecting over 900 users with combined losses of 5 billion won.

Upbit alone accounted for six incidents, with more than 600 victims suffering 3 billion won in damages.

Draft legislation is expected to mandate IT security infrastructure plans, upgraded system standards, and significantly stronger penalties.

Lawmakers are considering revisions that would allow fines of up to 3 percent of annual revenue for hacking incidents, matching standards for traditional financial institutions and replacing the current 5 billion won cap.

The shift would fundamentally reshape accountability in Korea’s crypto industry by making exchanges liable to compensate victims, as banks must respond to security breaches or system failures.

The Upbit breach also exposed reporting failures, with the exchange waiting over six hours after detecting the hack at 5 a.m. to notify regulators at 10:58 a.m.

Ruling party lawmakers alleged that Dunamu deliberately delayed disclosure until after its scheduled merger with Naver Financial, which concluded at 10:50 a.m.

The regulatory tightening extends beyond security requirements into comprehensive anti-money laundering enforcement.

Korea’s Financial Intelligence Unit is preparing sanctions against major exchanges following on-site inspections that examined compliance with Know Your Customer checks and suspicious transaction reporting.

The unit has already disciplined Dunamu with a three-month suspension on new customer activity and a 35.2 billion won fine, setting a precedent for penalties expected to reach hundreds of billions of won across the sector.

Authorities are simultaneously expanding the crypto travel rule to apply to transactions under 1 million won, closing a loophole that allowed users to evade identity checks by splitting transfers into smaller amounts.

“We will crack down on crypto money laundering, expanding the Travel Rule to transactions under 1 million won,” Financial Services Commission Chairman Lee Eok-won said during a National Assembly briefing.

The Financial Intelligence Unit will gain pre-emptive account-freezing powers in serious cases, while new rules will bar individuals with convictions for tax crimes or drug offenses from becoming major shareholders in licensed platforms.

Legislative amendments are expected in the first half of 2026 as Korea aligns with global standards through expanded coordination with the Financial Action Task Force.

— Cryptonews.com (@cryptonews) November 18, 2025

South Korean crypto tax may face a fourth delay to 2027 as proposed amendments fail to address framework issues. #CryptoTax #SouthKoreahttps://t.co/L0vuIlvbSu

The enforcement drive unfolds as Korea’s long-delayed crypto tax regime faces potential postponement beyond its January 2027 start date due to persistent infrastructure gaps, with no significant updates to the framework despite multiple deferrals since its 2020 approval.

Recently, lawmakers also set a December 10 deadline for the government to deliver a stablecoin regulatory framework, or face legislative action, with debates centering on whether banks should lead issuance or whether fintech firms should participate more actively.

Financial Supervisory Service Gov. Lee Chan-jin acknowledged the limits of current oversight despite the seriousness of the Upbit incident, stating that “regulatory oversight clearly has limits in imposing penalties” under existing law.

However, with the planned reforms, it aims to close these gaps as Korea positions itself to compete with major economies that have already formalized comprehensive digital asset frameworks.

The post Korea to Treat Crypto Exchanges Like Banks After Upbit Hack appeared first on Cryptonews.

The euro stablecoin market has staged a sharp rebound in the year since the EU’s Markets in Crypto-Assets Regulation (MiCA) took effect, doubling in size as new rules for issuers came online.

Key Takeaways:

According to Decta’s Euro Stablecoin Trends Report 2025, the sector’s market capitalization has surged from last year’s slump, reversing a 48% contraction and outpacing the broader stablecoin market’s 26% growth rate.

Decta’s report says euro-denominated stablecoins climbed to roughly $500 million by May 2025 following MiCA’s June 2024 rollout, a shift credited to clearer issuer obligations and standardized reserve rules.

Today, the market sits at around $680 million, per CoinGecko. However, the market is still tiny compared with the nearly $300 billion locked in US dollar-backed tokens, a space dominated by USDT and USDC.

Much of the growth came from a handful of standout issuers. Stasis’ EURS posted the strongest expansion, soaring 644% to $283.9 million as of October 2025.

Circle’s EURC and Societe Generale’s EURCV also saw meaningful increases as regulated issuers began to capitalize on MiCA’s clarity around custody, reserves and public disclosures.

Activity on-chain grew alongside market cap. Monthly transaction volume for euro stablecoins jumped nearly ninefold to $3.83 billion after MiCA implementation, the report found.

JUST IN:

— Futures (@FuturesDotNYC) December 3, 2025Ten European banks are building a euro stablecoin under Dutch Central Bank oversight.

They’re targeting regulatory approval in late 2026 pic.twitter.com/8zZv4d8Q5t

EURC and EURCV led the surge, with volumes climbing 1,139% and 343%, supported by greater use in cross-border payments, fiat on-ramps and crypto trading pairs, areas previously dominated by dollar stablecoins.

The regulatory shift also appears to be stimulating public interest. Decta recorded sharp spikes in search activity across EU markets, including a 400% jump in Finland and more than tripling in Italy.

Interest rose across smaller economies as well, suggesting broader consumer awareness as euro-denominated tokens begin carving out a clearer role in Europe’s digital-asset landscape.

As reported, Poland’s push to bring its crypto sector in line with the EU’s MiCA framework collapsed after lawmakers failed to overturn President Karol Nawrocki’s veto of a major digital-asset bill.

The vote fell short of the required three-fifths majority, leaving Poland as the only EU member without a national MiCA-style regulatory regime and forcing the government to restart the legislative process.

Prime Minister Donald Tusk had argued that the bill was necessary for national security, warning that unregulated crypto activity had become a channel for money laundering and foreign interference, including covert financing linked to Russia and Belarus.

Authorities have connected these concerns to several recent security incidents, including alleged sabotage plots in Poland reportedly funded through cryptocurrencies.

The veto has intensified political tensions between Nawrocki and Tusk’s pro-EU coalition.

The president rejected the bill on grounds that it overreached EU requirements and posed risks to civil liberties and property rights.

The post Euro Stablecoin Market Doubles to $680M A Year After MiCA appeared first on Cryptonews.

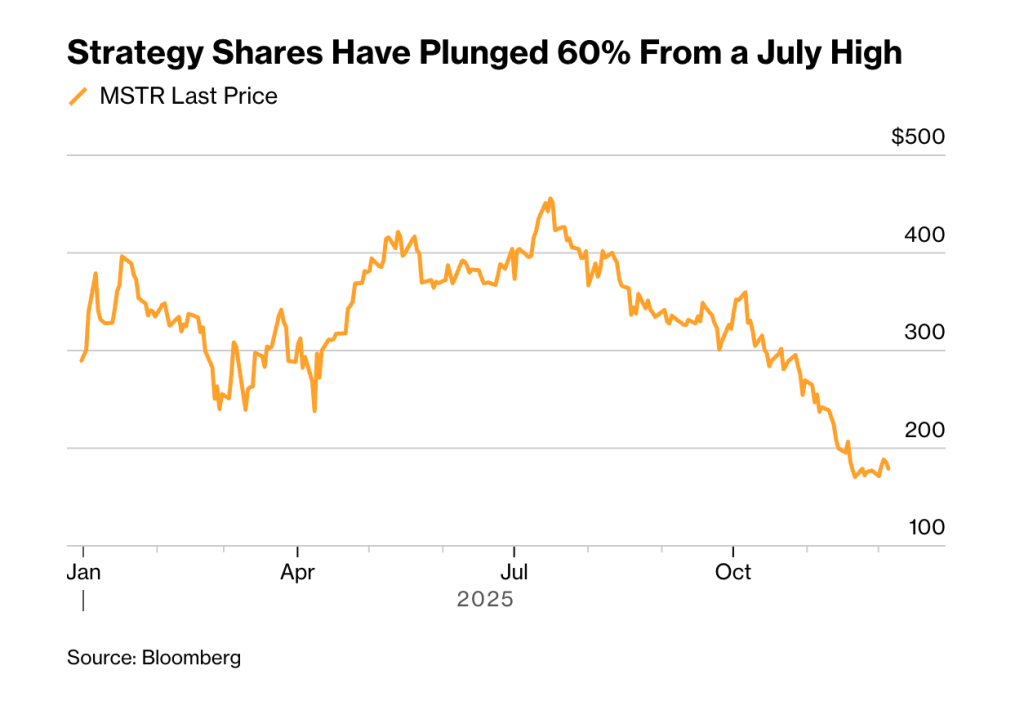

Digital asset treasury companies that rushed to copy Michael Saylor’s Bitcoin strategy are now hemorrhaging shareholder value, with median stock prices down 43% year to date, even as the broader market climbs higher, as per Bloomberg.

More than 100 publicly traded companies transformed themselves into cryptocurrency-holding vehicles in the first half of 2025, borrowing billions to buy digital tokens while their stock prices initially soared past the value of the underlying assets they purchased.

The strategy seemed unstoppable until market reality delivered a harsh correction.

Strategy Inc.’s Michael Saylor pioneered the approach of converting corporate cash into Bitcoin holdings, transforming his software company into a publicly traded cryptocurrency treasury.

The model worked spectacularly through the mid-2025, attracting high-profile investors, including the Trump family.

SharpLink Gaming epitomized the frenzy. The company pivoted from traditional gaming operations, appointed an Ethereum co-founder as chairman, and announced massive token purchases.

— Cryptonews.com (@cryptonews) October 27, 2025

Sharplink Gaming added $80M in Ether to its reserves, lifting total holdings to $3.6B and cementing its spot as the second-largest corporate holder of ETH.#Sharplink #Ether https://t.co/ADz76OeiCn

Its stock exploded 2,600% within days before crashing 86% from peak levels, leaving total market capitalization below the value of its Ethereum holdings at just 0.9 times crypto reserves.

Bloomberg data tracking 138 U.S. and Canadian digital asset treasuries shows the median share price has fallen 43% year-to-date, dramatically underperforming Bitcoin’s modest 7% decline.

In comparison, the S&P 500 gained 6% and the Nasdaq 100 rose 10%.

Strategy shares have dropped 60% from their July highs, even as they have risen by more than 1,200% since the company began buying Bitcoin in August 2020.

“Investors took a look and understood that there’s not much yield from these holdings rather than just sitting on this pile of money,” B. Riley Securities analyst Fedor Shabalin told Bloomberg.

The fundamental problem plaguing these companies stems from how they fund cryptocurrency purchases.

Strategy and its imitators issued massive amounts of convertible bonds and preferred shares, raising over $45 billion across the industry to acquire digital tokens that generate no cash flow.

These debt instruments carry substantial interest and dividend obligations that cryptocurrency holdings cannot service, creating a structural mismatch between liabilities that require regular payments and assets that produce zero income.

Strategy faces annual fixed obligations of approximately $750 million to $800 million tied to preferred shares.

Companies that avoided Bitcoin for smaller, more volatile cryptocurrencies suffered the steepest losses.

Alt5 Sigma, backed by two Trump sons and planning to purchase over $1 billion in World Liberty Financial’s WLFI token, has crashed more than 85% from its June peak.

Strategy attempted to address funding concerns by raising $1.44 billion in dollar reserves through stock sales, covering 21 months of dividend payments.

The industry now faces its defining moment. Strategy CEO Phong Le acknowledged the company would sell Bitcoin if needed to fund dividend payments, specifically if the firm’s market value falls below its cryptocurrency holdings.

Those comments sent shockwaves through the digital asset treasury sector, given Saylor’s repeated insistence that Strategy would never sell, famously joking in February to “sell a kidney if you must, but keep the Bitcoin.“

At December’s Binance Blockchain Week, Saylor outlined the revised approach, stating that “when our equity is trading above the net asset value of the Bitcoin, we just sell the equity,” but “when the equity’s trading below the value of the Bitcoin, we would either sell Bitcoin derivatives, or we would just sell the Bitcoin.“

The reversal raises fears of a downward spiral where forced crypto sales push token prices lower, further pressuring treasury company valuations and potentially triggering additional selling.

Strategy’s monthly Bitcoin accumulation has collapsed from 134,000 BTC at the 2024 peak to just 9,100 BTC in November, with only 135 BTC added so far in December.

The company now holds approximately 650,000 BTC, valued at over $56 billion, representing more than 3% of Bitcoin’s maximum supply.

Market participants worry that leveraged traders using borrowed money to invest in these companies could face margin calls, forcing broader market selloffs.

Strategy has created a $1.4 billion reserve fund to cover near-term dividend payments, but shares remain on track for a 38% decline this year despite the company’s massive Bitcoin holdings.

The post Michael Saylor’s Bitcoin Playbook Backfires on 100+ Companies appeared first on Cryptonews.

The world of Governance, Risk, and Compliance (GRC) is evolving faster than ever. With enterprises adopting AI-powered tools across all departments, organisations are realising that effective AI governance is no longer optional. It is now a core pillar of modern GRC.

This article explains what GRC means today, how AI governance fits inside GRC, the global frameworks shaping AI adoption, the maturity models, the Responsible AI skills companies expect, and why mastering AI governance creates a competitive advantage for professionals entering or growing in GRC.

GRC stands for Governance, Risk, and Compliance. It is a structured approach that ensures an organization:

In 2026, GRC is no longer just about audits or documentation. It is a strategic capability that helps companies scale, respond to cyber threats, maintain trust, and prevent legal problems.

AI systems now influence major business decisions across finance, HR, cybersecurity, fraud detection, privacy, and more. Because AI models can make mistakes, show bias, or act unpredictably, companies need clear processes to govern them.

In simple words: AI Governance adds a new risk category → “AI Risk”.

AI governance is becoming increasingly standardized. These are the most influential frameworks globally:

The world’s first certifiable AI governance standard. It focuses on:

Includes four core functions:

The strongest AI regulation, classifying AI into:

Focus on fairness, human-centered design, transparency, and accountability.

India is steadily moving toward Responsible AI policies aligned with global frameworks.

Organizations follow a structured approach when integrating AI governance:

Companies now require employees to complete:

This makes AI safer, fair, and accountable—and increases the value of GRC professionals.

Organizations measure their AI readiness through the following levels:

Most organizations in 2026 fall between Level 2 and 3.

AI governance is the fastest-growing discipline within GRC. Here’s why:

Learning AI governance immediately boosts long-term career value.

Following a fresh wave of bearish pressure on Friday, December 5, the price of Bitcoin has struggled beneath the psychological 90,000 level for much of the weekend. However, the latest on-chain data suggests that the premier cryptocurrency might be readying for its next healthy upward move.

In a December 6 post on the X platform, CryptoOnchain hypothesized that a local bottom appears to be forming for the price of Bitcoin. According to the market pundit, the selling pressure, especially amongst long-term holders, seems to be fading off at the moment.

This market observation centers on the Spent Output Profit Ratio (SOPR) metric, which evaluates the profitability ratio of spent outputs for both long-term and short-term holders. This on-chain indicator evaluates whether market participants are selling their assets at a profit or at a loss.

Typically, when the Bitcoin Spent Output Profit Ratio has a value greater than 1, it indicates that the investors are selling at a profit. On the flip side, an SOPR value less than 1 implies that the market participants are offloading their coins while in the red.

According to CryptoOnchain, the Bitcoin SOPR has now fallen to 1.35, its lowest level since early 2024. The market analyst noted that this metric’s latest movement suggests a complete reset in market profitability, especially as the price of BTC slid beneath the $90,000 mark.

Furthermore, CryptoOnchain highlighted that the heavy profit-taking phase by long-term holders appears to be coming to an end, as exhaustion and fatigue increasingly spread among the bears. From a historical perspective, the SOPR metric falling to this low signals a local bottom is forming for the BTC price, especially as the market cools down.

Ultimately, CryptoOnchain revealed that a price rebound at this point could set the stage for Bitcoin’s next healthy upward rally.

As of this writing, the price of BTC stands at around $89,500, reflecting no significant changes in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is down by nearly 2% in the last seven days.

With the price of Bitcoin down year-to-date and from its all-time high of $126,080 by roughly 5% and 30%, respectively, the market leader looks set to end 2025 in the red—barring a sudden change in market momentum.

The Bitcoin market appears to be riddled with an increasing amount of sell-side pressure, as its recent price action reveals bears’ dominance. Interestingly, another on-chain evaluation suggests that the current market movement may be a direct effect of rising panic-induced sales.

In a Quicktake post on the CryptoQuant platform, GugaOnChain shared that the Bitcoin market has been in a capitulation phase in recent days. This on-chain observation revolves around the Bitcoin Realized Profit and Loss ($) metric.

For context, this metric tracks the actual profits (in US dollars) and losses investors realize—or lock in—whenever they offload their Bitcoin holdings to exchanges.

GugaOnChain highlighted that about $1.705 billion worth of BTC has been realized in losses by market participants. On the other hand, a relatively smaller amount, totaling approximately $605 million, was reportedly realized in gains.![]()

Source: CryptoOnchainThis disproportionate distribution in losses, as against the profits acquired, puts the Loss/Gain ratio at a 2.82 reading. This means that, for every dollar made in profit, almost 3 dollars are lost.

Looking at the bigger picture, the analyst pointed out that 74% of the total realized volume leans towards the red side of the market, leaving a mere 26% of the Bitcoin market in profits. When realized losses surge rapidly to overcome gains, it is often interpreted as a sign of capitulation.

Historically, extreme capitulation events tend to set the pace either for price recovery or even deeper downside movement. These two possibilities, however, remain dependent on the integrity of available inflection points.

Although the market odds currently seem stacked against the bulls, as the price takes on a bearish structure, the analyst also identified a few important zones that may determine Bitcoin’s next direction. GugaOnChain explained that, in the scenario where the bulls continue to bleed, the next price level presenting an opportunity of redemption lies around $71,450.

This specific price level is critical, as it represents the realized price for investors who have acquired Bitcoin for about 12–18 months.

Citing a more extreme scenario, the online pundit revealed that the next key support sits at $58,940. This zone is important as it is the realized price for investors whose coins are within the 18-month to 2-year age range.

On the weekly timeframe, however, price zones around $80,000 and $74,000 appear significant enough for a short-term price recovery. A bullish reversal could take place if these price levels were to meet the present downturn with significant opposing strength.

As of this writing, Bitcoin is valued at around $89,331, reflecting no significant movement in the past 24 hours.

The cryptocurrency market has had a year filled with ups and downs, with most large-cap digital assets turning in mixed performances in 2025. After a rough start to the year, things started to look up for the price of Bitcoin in the second and third quarters, as it set multiple all-time highs across the six-month period.

However, the flagship cryptocurrency has largely struggled in the final months of 2025, looking set to end the year in the red. Interestingly, the latest on-chain data and historical patterns suggest that the price of Bitcoin might be set for a fairly stronger yearly close than expected.

On Saturday, December 6, Alphractal CEO and founder Joao Wedson took to the X platform to share what to expect from the Bitcoin price in the last days of 2025. According to the on-chain expert, the market leader is likely to close the year in a sideways price range.

The relevant metric here is the Yearly Accumulated Negative Days, which tracks market resilience by measuring the number of days in a year where an asset’s daily price candlestick closed in the red.

According to historical data and patterns, Bitcoin typically witnesses an average of 170 days of negative price movement in a year. This mean figure or level provides insight into the stress threshold for the world’s largest cryptocurrency by market cap.

![]()

When the number of negative days is approaching or exceeds this threshold of 170 days, as Bitcoin already has in 2025, the selling pressure in the market tends to wane as fatigue sets in among the bears. Wedson revealed that the premier cryptocurrency has already accumulated 171 negative days so far in 2025.

The on-chain expert noted that exceeding this threshold “strongly suggests” that the price of Bitcoin might not witness any more negative days in the final few weeks of 2025. Wedson said that if a deeper correction is imminent for the market leader, it will most likely happen in the next year.

However, as the Alphractal founder highlighted, the Bitcoin price is more likely to end the year within a consolidation range. Adding further credence to this postulation is the lack of market demand, as seen with reduced capital influx into spot Bitcoin exchange-traded funds.

As of this writing, the price of BTC stands at around $89,397, reflecting a mere 0.3% drop in the past 24 hours.

![]()

There are very few small years for video games, but 2025 felt like a big and mildly weird one in a lot of ways.

It was a year relatively lacking in big-budget first-party bangers from the likes of PlayStation and Xbox, though you'll see a bit of the former on this list. Nintendo had a big year, finally launching the Switch 2, but still, the most talked-about game of the year was a Japanese RPG made in France. Aside from all of that, it was a big year for soccer, non-French-RPGs, lonely hikes, and hotly anticipated sequels to indie smash hits.

Enough of the preamble. Here are Mashable's (unranked) picks for the best video games of 2025.

For me, personally, 2025 was defined less by games that came out this year and more by a long-running series of turn-based RPGs known as Trails in the English-speaking world. There are more than a dozen of them, most of which are at least 50 hours long, and they all connect narratively. The best point of comparison, in terms of the breadth of its story and the sheer number of characters to keep track of, would probably be A Song of Ice and Fire. It's a massive commitment, but I have truly loved playing through the series this year.

And what a nice coincidence it was that developer Nihon Falcom decided to release a shiny new from-the-ground-up remake of Trails in the Sky, the very first game in the series, in late 2025. Aside from just being a great entry point into this incredible series, Trails in the Sky: 1st Chapter is an astounding RPG on its own merits. Its art style brims with personality, the unique real-time/turn-based hybrid combat is my personal favorite RPG combat of the year, and it's fascinating to see the seeds for future high-stakes storytelling planted in this humble, low-stakes adventure.

If any of this sounds at all interesting to you, start with this game and keep going after that. There's also a remake of the second game coming in the near future.

While I will stop short of calling Death Stranding director Hideo Kojima an unprecedented genius, I do think he represents what I would love to see out of big-budget game development: Eccentric creators with cool ideas given massive amounts of money to make whatever they want, no matter how off-putting the elevator pitch for the project might be.

Death Stranding 2 is certainly less off-putting than its flawed 2019 predecessor, thanks to more forgiving combat and an overall design philosophy that empowers the player more than it disempowers them. That doesn't make it any less goofy, though. This is a game with pizza-based martial arts, a kind and helpful talking doll by your side at all times, a truly confounding central performance from Norman Reedus, and a climactic shirtless electric guitar battle at its conclusion.

Most importantly, Death Stranding 2 is a much more confident take on the ultimate masculine power fantasy of being emotionally unavailable and pondering public infrastructure projects. Its personality shines through where it didn't in the first game, and it's going to stick with me as much as anything I played this year.

The first of two early Switch 2 exclusives on this list, Mario Kart World is also perhaps the most divisive game in that category so far. Some people, like me, love its focused design, increased sense of chaos, and astoundingly fun Knockout Tour mode. Other people feel that the open-world portion of World is half-baked and that a lack of post-launch support has stifled its long-term viability as a multiplayer game.

That's fine, I guess, but I never needed Mario Kart World to be Fortnite. In fact, I'm glad it's not. Nintendo created a great racing game full of fun activities to enjoy, and most importantly, it doesn't require your constant attention. If you want to put it down for weeks or months at a time and come back later, you won't miss anything. Mario Kart World also shies away from embarrassing, undignified corporate crossovers, rounding out its character roster with random Mario enemies instead of SpongeBob SquarePants and Hatsune Miku.

Between all of that and a truly astonishing and dense soundtrack full of loving renditions of songs from across the Mario universe, Mario Kart World is a great celebration of Nintendo's mascot and a great entry point into the Switch 2 as a console.

Despelote speaks for itself better than I could ever put into words. You should really just plop down $15, play through it in the 90 minutes it takes to finish, and come back here instead of reading more.

In case you can't or don't want to do that, though, Despelote is a first-person narrative adventure about growing up in Ecuador in the early 2000s, as the country's national men's soccer team attempts to qualify for the World Cup for the first time in its history. Time is measured by game days and further contextualized by political and economic instability that fades into the background because you're playing as a child who cares more about soccer than anything else in the world. Its environments are hazy and dreamlike, resembling half-formed childhood memories better than almost any other game I can think of.

More than anything, Despelote transports the player to a very particular time and place, focusing on a culture that often receives little attention in video games. I choose to celebrate that.

Our second Switch 2 exclusive understands one crucial aspect of video game design: Punching things until they explode is a lot of fun.

Donkey Kong Bananza is notable for a few reasons. One is that it marks the return of one of Nintendo's oldest characters as a 3D platformer hero, his first game in that role in 25 years. Another is that he got a fresh redesign and a new best friend in the infinitely charming Pauline, a singing teenage girl who joins DK on his quest to the core of the planet. Bananza marries tons of personality with highly destructible environments, all of which will fall to DK's fists on a long enough timeline.

A 3D platformer where you can ignore the baked-in level design and simply punch your way to the goal works remarkably well. I'm not sure if Bananza is as good as Super Mario Odyssey (the last game from this development team), but it's definitely worthy of being on this list.

PlayStation's Ghost of Yotei is one of the few games on this list that I have not personally had time to check out yet, but our reviewer George Yang adored his time with the open-world samurai adventure. His take on the quest design really stood out to me:

"Ghost of Yotei has one of the best open-world formats out there, and that’s due to how seamlessly its side quests and exploration unfold. As Atsu travels across Ezo, NPC characters will call out to her, signaling that they have a side quest for her to tackle. It’s worth doing them too, as they reward Atsu with new equipment or money to help her on her journey. The side quests aren’t mindless fetch quests either — each one has a story that expands Yotei’s lore and worldbuilding. For example, one quest had Atsu rescuing an imprisoned gambler who maintained a winning streak against Saitō’s lackeys, showing not only their lack of morals but their pettiness, too."

It's hard to make open-world games feel fresh in 2025, but by all accounts, Yotei does an admirable job of that. If you want to luxuriate in gorgeous visuals and do cool sword tricks for a few dozen hours, here you go.

I have to admit that Hades II has not stuck with me for hundreds of hours in the same way the first game did in 2020. Its faults include a story that wraps up in a rather unsatisfying manner and the fact that it's been done before.

Still, even taking into account a lack of novelty, I think Hades II just barely makes the cut here because more Hades is still more Hades. Developer Supergiant Games marries its usual excellent art direction, audio design, and variable combat mechanics into something that's downright thrilling to play at its best. Introducing a second route to the game also dramatically increased the variety therein. I don't think Hades II measures up to its predecessor, but it doesn't have to in order to make this list.

Baby Steps, the newest joint from developer Bennett Foddy, is a game you can consume entirely via social media clips of players failing hilariously, if you want. It's another in a long line of games about physics-based movement, where the act of walking requires intent and precision, and nothing is handled for you automatically. Merely going up a set of stairs is a challenge here. Turning the mundane into profound obstacles is a significant part of the appeal of Baby Steps and similar games.

On top of all of that, Baby Steps is just strange (complimentary). It's a game where weird things happen on a regular basis, as a reward for sticking with it through the frustration. I have a feeling Baby Steps will have some of the longest-lasting appeal of any 2025 release.

I don't know if any 2025 video game had more weight on its shoulders than Metroid Prime 4: Beyond. It's the first Prime game in 18 years, following extensive delays and a general sense among Metroid fans that Nintendo had lost interest in the series. It also had to contend with some pre-release controversy surrounding a certain engineer, which led some fans to believe the game was beyond saving before it even came out.

I am pleased to report that Metroid Prime 4 is great, regardless of the anxiety surrounding it. Samus Aran's latest adventure combines rock-solid level design with a haunting desert hub that you traverse on a kick-ass motorcycle. It's the best-looking Switch 2 game so far, and it has a great sense of atmosphere, along with excellent music. Most importantly, it proves that Metroid Prime can still work in a modern context, even if that engineer guy is really irritating.

At the risk of putting too many Nintendo games on this list, I do want to shout out Xenoblade Chronicles X: Definitive Edition. It's an oft-requested Switch remaster of the last great Wii U exclusive, a gargantuan open-world RPG about human refugees trying to make a life on a distant alien planet after Earth's destruction.

Xenoblade X has one of the three or four best open worlds in any video game, ever. Every inch of it is thoughtfully designed, including the vast, empty stretches of it. It feels alien and hostile when it needs to, and also awe-inspiring and beautiful when it needs to be those things, too. And after about 40 hours, you can fly around the world in a mech, which recontextualizes your relationship with the planet in a heartbeat. It's a remarkable progression of scale that I've never seen another open-world game pull off.

I mentioned earlier that the most talked-about game of 2025 was a JRPG made in France. That would be Clair Obscur: Expedition 33, a gorgeous turn-based RPG inspired by several genre classics (and some other, more obscure titles), but with a bleak tone and aesthetic all its own. Set in a world where everyone above a certain age is killed every year (with the number going down year by year), Clair Obscur tells a tale of loss and grief that didn't personally work for me, but did work for plenty of other people I know.

What did work for me was its excellent combat, which synthesizes turn-based battles with real-time dodge and counter mechanics. The result is a game where you can break the math, or just get really good at countering enemy attacks. Or, you can be like me and do both, resulting in a final boss fight that lasts about 20 seconds. The point is that Clair Obscur has excellent combat, great music, a fun world to explore, and exciting boss fights, regardless of how much its story does or doesn't affect you.

Samsung is undoubtedly one of the best TV brands out there. It sells a variety of budget, mid-range, and luxury models that deliver excellent performance across multiple verticals. These include design, low-latency gaming, picture quality, and smart home integration. One area that doesn’t receive much attention is sound.

The average consumer will be satisfied with their TV’s default sound settings. Those who value detail and nuance — not so much. Don’t get me wrong now. Samsung TVs are fine for enjoying music performances, movies, and video games. But many critics agree that their sound quality could be improved. Well, let’s change that.

Whether you already own a Samsung TV or plan to buy one, know that you can tweak the audio output on these devices for optimal listening. Numerous upscaling sound features are sitting on the backend waiting to be discovered. You just need to know what they are and where to find them. We assembled this guide to help you get started.

Here are 7 ways to greatly enhance the sonics on your Samsung TV.

The majority of Samsung TVs come with a manual 8-band EQ. It looks and operates similarly to the EQ on other wireless audio products (e.g., Bluetooth speakers, earbuds, headphones). Once opened, you can adjust the bass, midrange, and treble, which is done through the remote controller. If you need some assistance understanding frequency ranges, check out our guide on how to customize your EQ settings.

Home [Button] -> Settings -> Sound -> Expert Settings

Samsung offers three sound modes: Amplify, Adaptive Sound (Optimized), and Standard (default). Each mode modifies sound performance based on preference. Amplify will boost mids and high tones, which is ideal for dialogue-heavy content, while Optimized makes special effects more immersive. Standard is basically the equivalent of a flat EQ; sound is balanced with no emphasis on a specific frequency range.

Home [Button] -> Quick Settings -> Sound Mode -> Expert Settings (Newer Models)

Home [Button] -> Settings -> Sound -> Sound Mode (Older models)

This proprietary feature gets you surround sound by syncing your TV’s audio output with a Samsung soundbar. You can connect both devices using an HDMI cable, optical cable, or through Wi-Fi. Samsung says to change the source on the soundbar to “D.IN for a cable connection, or Wi-Fi when establishing an internet connection.” Press the Source button on your TV remote to cycle through options.

A more current Samsung TV is required for this setup. Click this hyperlink to check out a list of compatible models.

Home [Button] -> Settings -> Sound -> Sound Output on your TV -> select "TV + Soundbar"

Anyone who owns a pair of spatial audio headphones has likely experienced Dolby Atmos. It’s the most common 3D audio format out there. Enabling the feature will deliver theatrical surround sound best enjoyed in your living room. There is one caveat — you must own external speakers that support Dolby Atmos.

Home [Button] -> Settings -> Sound -> Expert Settings -> Dolby Atmos Input (toggle on)

Turning this on will equalize sound across different channels and sources and keep volume output consistent.

Home [Button] -> Settings -> Sound -> Expert Settings -> Auto Volume

Listeners with hearing impairments will want to take advantage of the Balance feature. Simply put, it allows you to freely adjust the sound to deliver more sound from the left or right speaker.

Home [Button] -> Settings -> Sound -> Expert Settings -> Balance

Think of Adaptive Sound as an auto-generated EQ. It analyzes a room’s acoustics and your TV’s audio signal in real time to create a clearer and more natural sound profile. Not every Samsung TV comes with the same version. You may see “Adaptive Sound,” “Adaptive Sound+,” or “Adaptive Sound Pro” when navigating through the settings.

Home [Button] -> Settings -> General & Privacy -> Intelligent Mode -> Adaptive Sound

Home [Button] -> Settings -> Sound -> Sound Mode -> Adaptive Sound (Newer TVs)

TL;DR: Live stream Toronto Raptors vs. Boston Celtics in the NBA for free with a 30-day trial of Amazon Prime. Access this free live stream from anywhere in the world with ExpressVPN.

The NBA season is taking shape. Not many fans expected the Toronto Raptors to be so high up in the standings at this stage, but those boys have got something good going this season. The energy is infectious, and they'll be expecting to roll over the Celtics this weekend.

If you want to watch Raptors vs. Celtics in the NBA for free from anywhere in the world, we have all the information you need.

Raptors vs. Celtics in the NBA starts at 3:30 p.m. ET on Dec. 7. This game takes place at the Scotiabank Arena.

Raptors vs. Celtics in the NBA is available to live stream for free with a 30-day trial of Amazon Prime.

This free live stream is geo-restricted to the UK, but anyone can secure access with a VPN. These tools can hide your real IP address (digital location) and connect you to a secure server in the UK, meaning you can access free live streams of the NBA from anywhere in the world.

Stream the NBA for free by following these simple steps:

Sign up for a 30-day trial of Amazon Prime (if you're not already a member)

Subscribe to a VPN (like ExpressVPN)

Download the app to your device of choice (the best VPNs have apps for Windows, Mac, iOS, Android, Linux, and more)

Open up the app and connect to a server in the UK

Watch the NBA from anywhere in the world on Prime Video

The best VPNs for streaming are not free, but they do tend to offer money-back guarantees or free trials. By leveraging these offers, you can watch NBA live streams without actually spending anything. This clearly isn't a long-term solution, but it does mean you can watch select games from the NBA before recovering your investment.

ExpressVPN is the best service for accessing free live streams on platforms like Prime Video, for a number of reasons:

Servers in 105 countries

Easy-to-use app available on all major devices including iPhone, Android, Windows, Mac, and more

Strict no-logging policy so your data is secure

Fast connection speeds free from throttling

Up to eight simultaneous connections

30-day money-back guarantee

A two-year subscription to ExpressVPN is on sale for $139 and includes an extra four months for free — 61% off for a limited time. This plan also includes a year of free unlimited cloud backup and a generous 30-day money-back guarantee. Alternatively, you can get a one-month plan for just $12.95 (with money-back guarantee).

Live stream the NBA for free with ExpressVPN.