Feudalism 2.0: How Big Tech became the new kings | Opinion

The FOMC meeting is scheduled for next Tuesday (December 9-10), and the market is almost unanimous on a dovish stance from the Fed.

Polymarket traders are pricing in a 92% probability of a 25-basis-point cut, which has shifted Bitcoin price analysis from a bearish breakdown to a potential comeback.

Federal Reserve Chair Jerome Powell is expected to proceed with another quarter-point rate reduction this week, even as several policymakers express concern about persistent inflation.

The Fed implemented its second consecutive cut in October, responding to unexpected weakness in the summer jobs data.

Following that decision, hawkish voices emerged among officials, including five current voting members, who indicated reluctance to support further easing in December.

The tide turned on November 21 when New York Fed President John Williams suggested conditions warranted a reduction in the “near term.”

Recent Bitcoin price analysis from Cryptonews highlights a critical on-chain metric gaining momentum.

Bitcoin “liveliness” is climbing again, a pattern that has historically coincided with bull market phases, suggesting the current cycle may have substantial upside remaining.

Analyst Michaël van de Poppe outlined a bullish scenario, anticipating short-term volatility before a sustained rally.

He expects pre-FOMC selling pressure today and Monday, potentially driving prices down to $87,000 to sweep liquidity at the lows.

This would be my bullish scenario.

— Michaël van de Poppe (@CryptoMichNL) December 7, 2025

Pre-FOMC and on Monday, correction to sweep the lows. Perhaps hitting $87K.

After that, bounce back up, swiftly, in which the uptrend is confirmed for #Bitcoin and it's ready to break $92K and therefore the run towards $100K in the coming 1-2… pic.twitter.com/lQezKkQM5W

“After that, bounce back up, swiftly, in which the uptrend is confirmed for Bitcoin and it’s ready to break $92,000

And therefore the run towards $100,000 in the coming 1-2 weeks as the Fed is reducing QT, doing rate cuts and expanding the money supply to increase the business cycle,” van de Poppe stated.

Technical analysis shows Bitcoin breaking out of a long descending red channel, signalling that the strongest phase of the downtrend has likely ended.

Price is currently hovering around the $89,000 zone, which sits just beneath a key resistance-turned-support area highlighted in orange.

Until BTC closes decisively above this zone, sellers can still create short-term pressure.

The breakout attempt already shows early strength, as BTC bounced from the lower channel region near $79,000 and pushed back toward mid-trend.

The next major resistance level is around $94,600, and clearing it would confirm bullish continuation.

If that happens, the chart projects upside targets at $108,000 and eventually $116,000, which align with previous liquidity zones.

As Bitcoin positions for a potential comeback driven by Fed rate cuts, presale projects like Maxi Doge (MAXI) are attracting investor attention.

MAXI is capturing the grassroots momentum that drove Dogecoin’s extraordinary 161,000x rally.

The project has secured over $4.2 million in funding while building an active community focused on sharing trading strategies and market opportunities.

Notably, 25% of capital raised will be invested in promising plays, with returns recycled into marketing initiatives and community rewards to accelerate growth.

Investors can join the presale at $0.000272 by visiting the official Maxi Doge website.

Then connect an Ethereum-compatible wallet like Best Wallet, and purchase MAXI with ETH, BNB, or USDT.

Bank card payments are also supported for instant access.

The post Bitcoin Price Analysis: 92% Fed Rate Cut Probability Sparks Bitcoin Comeback Talk appeared first on Cryptonews.

Bitcoin’s (BTC) ongoing price correction has been accompanied by several other negative developments that continue to grab investors’ attention. Most recently, market analyst Darkfost has observed a significant crash in Bitcoin spot trading volume, while highlighting potential long-term implications of such an event.

The spot trading volume refers to the total amount of Bitcoin that is bought and sold for immediate delivery on exchanges within a specific time period. It is a key market indicator used to gauge participation, liquidity, and investor interest. According to Darkfost in an X post on December 6, the Bitcoin market, in November, experienced a major fall in spot trading volume across major crypto exchanges. This development has been attributed to the asset’s price struggles, wherein it recorded a 17.5% devaluation during this period.

On Binance, which accounts for more than half of all Bitcoin spot trading activity, spot volume fell from $198 billion in October to $156 billion in November, representing a 21% decline. The downturn was mirrored across other major exchanges, with ByBit posting a 13.5% drop, Gate.io sliding 33%, and OKX down 18%.

Interestingly, Darkfost explains that Bitcoin’s recent price action, the major negative catalyst, pales in comparison to previous corrections. However, another red reading in December could initiate a market deterioration marked by conditions such as continued selling pressure, low market confidence, and, importantly, further drops in spot activity.

A continuous decline in spot trading volume primarily mirrors a lack of market interest and is accompanied by other concerning factors, such as a weaker demand, high vulnerability to price swings, and limited support for rallies as investors prefer to sit on the sidelines. This dynamic, in turn, weighs on price growth, creating a self-reinforcing bearish loop.

In related news, Darkfost also reports that the present market cycle has featured a consistent decline in spot trading volume peaks. Notably, the chart above shows a market high of $333.57 billion on Binance in March 2024, followed by the lower peak of $246.04 billion in November 2024, and then just $198.6 billion last October.

This trend becomes even more concerning when looking at the spot-to-futures volume ratio, which currently sits at 0.23, meaning futures activity now accounts for more than 75% of overall trading. In essence, while the Bitcoin market remains active, investor enthusiasm on the spot side is fading. By contrast, traders appear increasingly willing to speculate in the futures market, likely driven by elevated uncertainty and short-term volatility.

At press time, Bitcoin trades at $89,300, reflecting a 0.21% loss in the past day.

American multinational financial services company Western Union has unveiled a stablecoin strategy to expand its digital business and cross-border remittances. In particular, the money transfer firm is looking to launch a stablecoin card service targeted at nations with high inflation rates.

Matthew Cagwin, chief financial officer and executive vice-president at Western Union, has shared various ideas the financial service giant holds around the adoption and potential offerings of stablecoins. These revelations were made in a presentation at the UBS Global Technology and AI conference on December 2, 2025.

Notably, Cagwin acknowledges that Western Union views stablecoins as a significant opportunity to free the company’s cash flow for other purposes. Due to the instantaneous and predictable nature of these cryptocurrencies, the executive outlines a business model in which Western Union can settle transactions immediately, without needing to hold hundreds of millions of dollars for liquidity, as is typical in the traditional financial system.

Notably, Western Union also aims to offer a “stable card”, modeled on the prepaid card in the US but targeted at users in nations with high inflationary pressure. Cagwin explained the need for this product, referencing Argentina as an example.

The CFO said:

… If you’re — I have a big workforce in Argentina. Can you imagine living in a country where last year, your inflation was 250%, 300%. We gave our employees 4 raises last year because if you didn’t, they made — they couldn’t afford their bills. So imagine a world where your family in the U.S. is sending you $500 home, but by the time you spend it in the next month, it’s only worth $300. So we can see a good utility for our stable card there,…

Cagwin also explains Western Union’s ongoing efforts to establish a digital asset network (DAN). Notably, the financial services firm has established partnerships with four service providers with the intent to offer on-ramp and off-ramp services to users from H1 2026, using the yellow wallets and agents, such as a big box store or check casher.

In addition to the stable card, Cagwin states that Western Union plans to launch a stablecoin, which they believe will scale easily, considering their present business network. In opting against onboarding existing stablecoins, Cagwin explains the firm’s goal of maintaining end-to-end of the proposed coin’s use, economics, and distribution operation.

At press time, the total crypto market cap is valued at $3.05 trillion, after a 0.37% gain in the last day. Meanwhile, total stablecoins are valued at $317.63 billion, representing 10% of circulating digital assets.

![]()

Bitcoin Cash has outpaced every major L1 in 2025, boosted by clean supply dynamics and renewed investor demand.

A key on-chain indicator known as Bitcoin “liveliness” is climbing again, a pattern historically associated with bull market activity, raising the possibility that the current cycle still has room to run, according to analysts tracking long-term blockchain metrics.

Key Takeaways:

Technical analyst TXMC said on Sunday that liveliness has been “marching higher despite lower prices,” a divergence that suggests steady underlying demand for spot Bitcoin even as market sentiment remains subdued.

The metric, described as an “elegant” long-term gauge of chain activity, measures the ratio of coins being transacted relative to those being held, weighted by their age.

It increases when older coins are spent more frequently, and falls when long-term holders accumulate.

“Liveliness usually rises in bull runs as supply changes hands at higher prices, indicating a flow of newly invested capital,” TXMC explained, noting that the latest upward trend contradicts the muted price action seen in recent weeks.

Glassnode data shows liveliness pushing into a new peak range, breaking out of the corridor it remained stuck in from the 2017 all-time-high through earlier cycles.

Analyst James Check said the current spike in liveliness reflects an unprecedented reactivation of dormant Bitcoin supply, surpassing patterns seen during the 2017 bull run, the first cycle characterized by “widespread participation” and a dramatic parabolic surge.

Liveliness has been range bound since the 2017 peak, up until now.

— _Checkmate

The 2017 Bull was special in that it was the first epic parabola with widespread participation, but was also when many old coins transacted to capture the BCH dividend.

New Liveliness ATHs shows how extreme the… https://t.co/aoVFr2jOsR(@_Checkmatey_) December 6, 2025

This time, however, the scale is far larger. While 2017 typically saw transfers measured in the thousands of dollars, Check noted that today’s on-chain value flows often reach into the billions, signaling one of the largest capital rotations Bitcoin has experienced.

“We have seen an extraordinary volume of coin days destroyed,” Check said. “I am of the view we have just watched one of the greatest capital rotations and changing of the guard in Bitcoin history.”

Bitcoin’s price action remains subdued despite the on-chain strength. BTC briefly dipped below $89,000 early Sunday before recovering to around $89,500, largely unchanged over 24 hours.

Analyst Michaël van de Poppe said the market is stuck in a consolidation band: “Anything between $86,000 and $92,000 is pretty much noise.”

Anything between $86-92K is pretty much noise. Not much will happen for $BTC.

— Michaël van de Poppe (@CryptoMichNL) December 6, 2025

If $92K gets tested, I think we'll break it, but if not, brace yourself for a test at the low $80K range for some sort of double-bottom pattern.

Again, I don't think we're far off bottoming for… pic.twitter.com/6acTFBAZk4

He added that a test of $92,000 could lead to a breakout, while failure could push BTC toward the low $80,000s for a potential double-bottom formation.

“I don’t think we’re far off bottoming for Bitcoin,” van de Poppe said, predicting a stronger rally heading into late Q4 and early Q1.

Last week, Bitfinex said the market is showing “seller exhaustion” following a period of heavy deleveraging and panic-driven exits by short-term holders.

“The combination of extreme deleveraging, capitulation among short-term holders, and early signs of seller exhaustion has created the conditions for a stabilisation phase and a relief bounce,” the firm wrote.

The post Bitcoin “Liveliness” Indicator Rises, Hinting the Bull Cycle May Not Be Over appeared first on Cryptonews.

Ether held on centralized exchanges has fallen to its lowest level in history, fueling speculation that a supply squeeze may be forming beneath the surface of the market.

Key Takeaways:

According to Glassnode, exchange balances dropped to 8.7% of total ETH supply last Thursday, the smallest share recorded since Ethereum’s launch in 2015. Levels remained near that low at 8.8% on Sunday.

The sharp decline represents a 43% drop in ETH exchange balances since early July, coinciding with the acceleration of digital asset treasury (DAT) purchases and growing activity across the broader Ethereum ecosystem.

Macro research outlet Milk Road said ETH is “quietly entering its tightest supply environment ever,” noting that Bitcoin’s exchange balance remains significantly higher at 14.7%.

Analysts attributed the shift to structural changes in how ETH is being used. More tokens are flowing into staking, restaking protocols, layer-2 networks, DAT balance sheets, collateralized DeFi positions, and long-term self-custody, destinations that historically do not circulate supply back onto exchanges.

“Sentiment feels heavy right now, but sentiment doesn’t dictate supply,” Milk Road wrote. “When that gap closes, price follows.”

Beyond supply metrics, market technicians are spotting signals that buyers may be gaining control. Analyst Sykodelic highlighted an On-Balance Volume (OBV) breakout above resistance late last week, even as price failed to follow.

$ETH is quietly entering its tightest supply environment ever.

— Milk Road (@MilkRoad) December 5, 2025

Exchange balances just fell to 8.84% of total supply, a level we’ve never seen before.

For context, $BTC is still sitting near 14.8%.

ETH keeps getting pulled into places that don’t sell, staking, restaking, L2… pic.twitter.com/T7MW3D2bG1

The divergence, they said, is a classic sign of “hidden buying strength” that sometimes precedes upward moves.

“This is a sign of buying strength, and typically, the price will follow,” the analyst noted, while cautioning that indicators aren’t guarantees.

They added that overall price action “looks bullish,” suggesting ETH may revisit higher levels before any meaningful retracement.

Ether has held above the $3,000 mark for nearly a week but continues to face resistance near $3,200. Over the past 24 hours, ETH has consolidated around $3,050, mirroring the broader market’s indecision.

The ETH/BTC pair also drew attention last week after breaking above a long-standing downtrend, a move some traders see as an early sign of capital rotating back into Ethereum.

Meanwhile, BitMine Immersion Technologies, already the largest corporate holder of Ether, has continued aggressively buying the dip even as top traders position for further declines.

The firm purchased another $199 million in ETH over the past two days, adding to its rapidly expanding reserves.

BitMine now controls $11.3 billion worth of Ether, roughly 3.08% of the total supply, and is closing in on its long-stated goal of reaching 5%.

Last month, Tom Lee said Ether may be entering the early stages of the type of explosive growth cycle that propelled Bitcoin to a 100x rally since 2017.

Lee said the current Ether market resembles Bitcoin’s setup eight years ago, a period marked by deep volatility that ultimately preceded one of the strongest bull cycles in crypto history.

The post Ether Supply on Exchanges Falls to Record Low, Raising Supply Squeeze Hopes appeared first on Cryptonews.

South Korea is moving to impose bank-level liability standards on crypto exchanges following a $30.1 million hack at Upbit last month, shifting toward treating major platforms with the same regulatory rigor as traditional financial institutions.

According to The Korea Times, the Financial Services Commission is reviewing provisions that would require crypto exchanges to compensate users for losses caused by hacking or system failures, regardless of fault, mirroring rules currently applied only to banks and electronic payment firms under the country’s electronic financial transactions law.

The push follows a Nov. 27 breach at Upbit that saw over 104 billion Solana-based tokens worth 44.5 billion won ($36M) transferred to external wallets in just 54 minutes.

Despite the incident, the exchange faced minimal penalties since regulators cannot order compensation under existing laws.

— Cryptonews.com (@cryptonews) November 27, 2025

South Korea’s largest crypto exchange Upbit @Official_Upbit reported a $36m Solana network hack on Thursday, halting withdrawals on the spot and pledging to fully reimburse affected customers.

The incident comes on the same date as its 2019 breach l…https://t.co/o0VLiqKin7

The planned reforms come amid a pattern of platform instability across Korea’s crypto sector.

Financial Supervisory Service data shows the five major exchanges, Upbit, Bithumb, Coinone, Korbit, and Gopax, recorded 20 system failures between 2023 and September this year, affecting over 900 users with combined losses of 5 billion won.

Upbit alone accounted for six incidents, with more than 600 victims suffering 3 billion won in damages.

Draft legislation is expected to mandate IT security infrastructure plans, upgraded system standards, and significantly stronger penalties.

Lawmakers are considering revisions that would allow fines of up to 3 percent of annual revenue for hacking incidents, matching standards for traditional financial institutions and replacing the current 5 billion won cap.

The shift would fundamentally reshape accountability in Korea’s crypto industry by making exchanges liable to compensate victims, as banks must respond to security breaches or system failures.

The Upbit breach also exposed reporting failures, with the exchange waiting over six hours after detecting the hack at 5 a.m. to notify regulators at 10:58 a.m.

Ruling party lawmakers alleged that Dunamu deliberately delayed disclosure until after its scheduled merger with Naver Financial, which concluded at 10:50 a.m.

The regulatory tightening extends beyond security requirements into comprehensive anti-money laundering enforcement.

Korea’s Financial Intelligence Unit is preparing sanctions against major exchanges following on-site inspections that examined compliance with Know Your Customer checks and suspicious transaction reporting.

The unit has already disciplined Dunamu with a three-month suspension on new customer activity and a 35.2 billion won fine, setting a precedent for penalties expected to reach hundreds of billions of won across the sector.

Authorities are simultaneously expanding the crypto travel rule to apply to transactions under 1 million won, closing a loophole that allowed users to evade identity checks by splitting transfers into smaller amounts.

“We will crack down on crypto money laundering, expanding the Travel Rule to transactions under 1 million won,” Financial Services Commission Chairman Lee Eok-won said during a National Assembly briefing.

The Financial Intelligence Unit will gain pre-emptive account-freezing powers in serious cases, while new rules will bar individuals with convictions for tax crimes or drug offenses from becoming major shareholders in licensed platforms.

Legislative amendments are expected in the first half of 2026 as Korea aligns with global standards through expanded coordination with the Financial Action Task Force.

— Cryptonews.com (@cryptonews) November 18, 2025

South Korean crypto tax may face a fourth delay to 2027 as proposed amendments fail to address framework issues. #CryptoTax #SouthKoreahttps://t.co/L0vuIlvbSu

The enforcement drive unfolds as Korea’s long-delayed crypto tax regime faces potential postponement beyond its January 2027 start date due to persistent infrastructure gaps, with no significant updates to the framework despite multiple deferrals since its 2020 approval.

Recently, lawmakers also set a December 10 deadline for the government to deliver a stablecoin regulatory framework, or face legislative action, with debates centering on whether banks should lead issuance or whether fintech firms should participate more actively.

Financial Supervisory Service Gov. Lee Chan-jin acknowledged the limits of current oversight despite the seriousness of the Upbit incident, stating that “regulatory oversight clearly has limits in imposing penalties” under existing law.

However, with the planned reforms, it aims to close these gaps as Korea positions itself to compete with major economies that have already formalized comprehensive digital asset frameworks.

The post Korea to Treat Crypto Exchanges Like Banks After Upbit Hack appeared first on Cryptonews.

The euro stablecoin market has staged a sharp rebound in the year since the EU’s Markets in Crypto-Assets Regulation (MiCA) took effect, doubling in size as new rules for issuers came online.

Key Takeaways:

According to Decta’s Euro Stablecoin Trends Report 2025, the sector’s market capitalization has surged from last year’s slump, reversing a 48% contraction and outpacing the broader stablecoin market’s 26% growth rate.

Decta’s report says euro-denominated stablecoins climbed to roughly $500 million by May 2025 following MiCA’s June 2024 rollout, a shift credited to clearer issuer obligations and standardized reserve rules.

Today, the market sits at around $680 million, per CoinGecko. However, the market is still tiny compared with the nearly $300 billion locked in US dollar-backed tokens, a space dominated by USDT and USDC.

Much of the growth came from a handful of standout issuers. Stasis’ EURS posted the strongest expansion, soaring 644% to $283.9 million as of October 2025.

Circle’s EURC and Societe Generale’s EURCV also saw meaningful increases as regulated issuers began to capitalize on MiCA’s clarity around custody, reserves and public disclosures.

Activity on-chain grew alongside market cap. Monthly transaction volume for euro stablecoins jumped nearly ninefold to $3.83 billion after MiCA implementation, the report found.

JUST IN:

— Futures (@FuturesDotNYC) December 3, 2025Ten European banks are building a euro stablecoin under Dutch Central Bank oversight.

They’re targeting regulatory approval in late 2026 pic.twitter.com/8zZv4d8Q5t

EURC and EURCV led the surge, with volumes climbing 1,139% and 343%, supported by greater use in cross-border payments, fiat on-ramps and crypto trading pairs, areas previously dominated by dollar stablecoins.

The regulatory shift also appears to be stimulating public interest. Decta recorded sharp spikes in search activity across EU markets, including a 400% jump in Finland and more than tripling in Italy.

Interest rose across smaller economies as well, suggesting broader consumer awareness as euro-denominated tokens begin carving out a clearer role in Europe’s digital-asset landscape.

As reported, Poland’s push to bring its crypto sector in line with the EU’s MiCA framework collapsed after lawmakers failed to overturn President Karol Nawrocki’s veto of a major digital-asset bill.

The vote fell short of the required three-fifths majority, leaving Poland as the only EU member without a national MiCA-style regulatory regime and forcing the government to restart the legislative process.

Prime Minister Donald Tusk had argued that the bill was necessary for national security, warning that unregulated crypto activity had become a channel for money laundering and foreign interference, including covert financing linked to Russia and Belarus.

Authorities have connected these concerns to several recent security incidents, including alleged sabotage plots in Poland reportedly funded through cryptocurrencies.

The veto has intensified political tensions between Nawrocki and Tusk’s pro-EU coalition.

The president rejected the bill on grounds that it overreached EU requirements and posed risks to civil liberties and property rights.

The post Euro Stablecoin Market Doubles to $680M A Year After MiCA appeared first on Cryptonews.

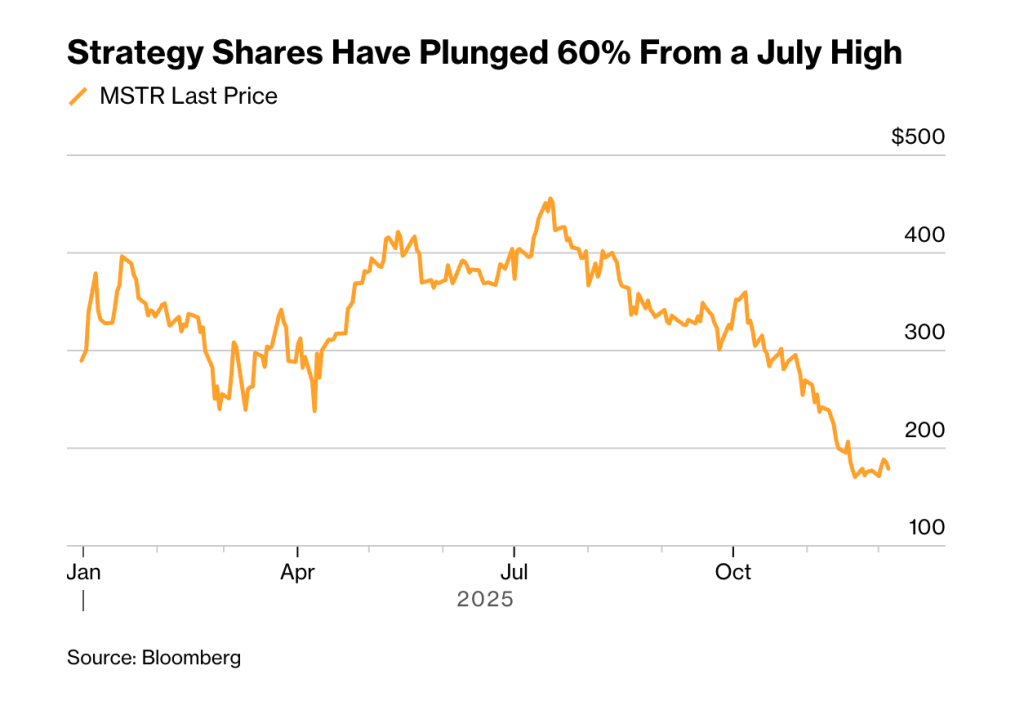

Digital asset treasury companies that rushed to copy Michael Saylor’s Bitcoin strategy are now hemorrhaging shareholder value, with median stock prices down 43% year to date, even as the broader market climbs higher, as per Bloomberg.

More than 100 publicly traded companies transformed themselves into cryptocurrency-holding vehicles in the first half of 2025, borrowing billions to buy digital tokens while their stock prices initially soared past the value of the underlying assets they purchased.

The strategy seemed unstoppable until market reality delivered a harsh correction.

Strategy Inc.’s Michael Saylor pioneered the approach of converting corporate cash into Bitcoin holdings, transforming his software company into a publicly traded cryptocurrency treasury.

The model worked spectacularly through the mid-2025, attracting high-profile investors, including the Trump family.

SharpLink Gaming epitomized the frenzy. The company pivoted from traditional gaming operations, appointed an Ethereum co-founder as chairman, and announced massive token purchases.

— Cryptonews.com (@cryptonews) October 27, 2025

Sharplink Gaming added $80M in Ether to its reserves, lifting total holdings to $3.6B and cementing its spot as the second-largest corporate holder of ETH.#Sharplink #Ether https://t.co/ADz76OeiCn

Its stock exploded 2,600% within days before crashing 86% from peak levels, leaving total market capitalization below the value of its Ethereum holdings at just 0.9 times crypto reserves.

Bloomberg data tracking 138 U.S. and Canadian digital asset treasuries shows the median share price has fallen 43% year-to-date, dramatically underperforming Bitcoin’s modest 7% decline.

In comparison, the S&P 500 gained 6% and the Nasdaq 100 rose 10%.

Strategy shares have dropped 60% from their July highs, even as they have risen by more than 1,200% since the company began buying Bitcoin in August 2020.

“Investors took a look and understood that there’s not much yield from these holdings rather than just sitting on this pile of money,” B. Riley Securities analyst Fedor Shabalin told Bloomberg.

The fundamental problem plaguing these companies stems from how they fund cryptocurrency purchases.

Strategy and its imitators issued massive amounts of convertible bonds and preferred shares, raising over $45 billion across the industry to acquire digital tokens that generate no cash flow.

These debt instruments carry substantial interest and dividend obligations that cryptocurrency holdings cannot service, creating a structural mismatch between liabilities that require regular payments and assets that produce zero income.

Strategy faces annual fixed obligations of approximately $750 million to $800 million tied to preferred shares.

Companies that avoided Bitcoin for smaller, more volatile cryptocurrencies suffered the steepest losses.

Alt5 Sigma, backed by two Trump sons and planning to purchase over $1 billion in World Liberty Financial’s WLFI token, has crashed more than 85% from its June peak.

Strategy attempted to address funding concerns by raising $1.44 billion in dollar reserves through stock sales, covering 21 months of dividend payments.

The industry now faces its defining moment. Strategy CEO Phong Le acknowledged the company would sell Bitcoin if needed to fund dividend payments, specifically if the firm’s market value falls below its cryptocurrency holdings.

Those comments sent shockwaves through the digital asset treasury sector, given Saylor’s repeated insistence that Strategy would never sell, famously joking in February to “sell a kidney if you must, but keep the Bitcoin.“

At December’s Binance Blockchain Week, Saylor outlined the revised approach, stating that “when our equity is trading above the net asset value of the Bitcoin, we just sell the equity,” but “when the equity’s trading below the value of the Bitcoin, we would either sell Bitcoin derivatives, or we would just sell the Bitcoin.“

The reversal raises fears of a downward spiral where forced crypto sales push token prices lower, further pressuring treasury company valuations and potentially triggering additional selling.

Strategy’s monthly Bitcoin accumulation has collapsed from 134,000 BTC at the 2024 peak to just 9,100 BTC in November, with only 135 BTC added so far in December.

The company now holds approximately 650,000 BTC, valued at over $56 billion, representing more than 3% of Bitcoin’s maximum supply.

Market participants worry that leveraged traders using borrowed money to invest in these companies could face margin calls, forcing broader market selloffs.

Strategy has created a $1.4 billion reserve fund to cover near-term dividend payments, but shares remain on track for a 38% decline this year despite the company’s massive Bitcoin holdings.

The post Michael Saylor’s Bitcoin Playbook Backfires on 100+ Companies appeared first on Cryptonews.

Following a fresh wave of bearish pressure on Friday, December 5, the price of Bitcoin has struggled beneath the psychological 90,000 level for much of the weekend. However, the latest on-chain data suggests that the premier cryptocurrency might be readying for its next healthy upward move.

In a December 6 post on the X platform, CryptoOnchain hypothesized that a local bottom appears to be forming for the price of Bitcoin. According to the market pundit, the selling pressure, especially amongst long-term holders, seems to be fading off at the moment.

This market observation centers on the Spent Output Profit Ratio (SOPR) metric, which evaluates the profitability ratio of spent outputs for both long-term and short-term holders. This on-chain indicator evaluates whether market participants are selling their assets at a profit or at a loss.

Typically, when the Bitcoin Spent Output Profit Ratio has a value greater than 1, it indicates that the investors are selling at a profit. On the flip side, an SOPR value less than 1 implies that the market participants are offloading their coins while in the red.

According to CryptoOnchain, the Bitcoin SOPR has now fallen to 1.35, its lowest level since early 2024. The market analyst noted that this metric’s latest movement suggests a complete reset in market profitability, especially as the price of BTC slid beneath the $90,000 mark.

Furthermore, CryptoOnchain highlighted that the heavy profit-taking phase by long-term holders appears to be coming to an end, as exhaustion and fatigue increasingly spread among the bears. From a historical perspective, the SOPR metric falling to this low signals a local bottom is forming for the BTC price, especially as the market cools down.

Ultimately, CryptoOnchain revealed that a price rebound at this point could set the stage for Bitcoin’s next healthy upward rally.

As of this writing, the price of BTC stands at around $89,500, reflecting no significant changes in the past 24 hours. According to data from CoinGecko, the flagship cryptocurrency is down by nearly 2% in the last seven days.

With the price of Bitcoin down year-to-date and from its all-time high of $126,080 by roughly 5% and 30%, respectively, the market leader looks set to end 2025 in the red—barring a sudden change in market momentum.

The Bitcoin market appears to be riddled with an increasing amount of sell-side pressure, as its recent price action reveals bears’ dominance. Interestingly, another on-chain evaluation suggests that the current market movement may be a direct effect of rising panic-induced sales.

In a Quicktake post on the CryptoQuant platform, GugaOnChain shared that the Bitcoin market has been in a capitulation phase in recent days. This on-chain observation revolves around the Bitcoin Realized Profit and Loss ($) metric.

For context, this metric tracks the actual profits (in US dollars) and losses investors realize—or lock in—whenever they offload their Bitcoin holdings to exchanges.

GugaOnChain highlighted that about $1.705 billion worth of BTC has been realized in losses by market participants. On the other hand, a relatively smaller amount, totaling approximately $605 million, was reportedly realized in gains.![]()

Source: CryptoOnchainThis disproportionate distribution in losses, as against the profits acquired, puts the Loss/Gain ratio at a 2.82 reading. This means that, for every dollar made in profit, almost 3 dollars are lost.

Looking at the bigger picture, the analyst pointed out that 74% of the total realized volume leans towards the red side of the market, leaving a mere 26% of the Bitcoin market in profits. When realized losses surge rapidly to overcome gains, it is often interpreted as a sign of capitulation.

Historically, extreme capitulation events tend to set the pace either for price recovery or even deeper downside movement. These two possibilities, however, remain dependent on the integrity of available inflection points.

Although the market odds currently seem stacked against the bulls, as the price takes on a bearish structure, the analyst also identified a few important zones that may determine Bitcoin’s next direction. GugaOnChain explained that, in the scenario where the bulls continue to bleed, the next price level presenting an opportunity of redemption lies around $71,450.

This specific price level is critical, as it represents the realized price for investors who have acquired Bitcoin for about 12–18 months.

Citing a more extreme scenario, the online pundit revealed that the next key support sits at $58,940. This zone is important as it is the realized price for investors whose coins are within the 18-month to 2-year age range.

On the weekly timeframe, however, price zones around $80,000 and $74,000 appear significant enough for a short-term price recovery. A bullish reversal could take place if these price levels were to meet the present downturn with significant opposing strength.

As of this writing, Bitcoin is valued at around $89,331, reflecting no significant movement in the past 24 hours.

The cryptocurrency market has had a year filled with ups and downs, with most large-cap digital assets turning in mixed performances in 2025. After a rough start to the year, things started to look up for the price of Bitcoin in the second and third quarters, as it set multiple all-time highs across the six-month period.

However, the flagship cryptocurrency has largely struggled in the final months of 2025, looking set to end the year in the red. Interestingly, the latest on-chain data and historical patterns suggest that the price of Bitcoin might be set for a fairly stronger yearly close than expected.

On Saturday, December 6, Alphractal CEO and founder Joao Wedson took to the X platform to share what to expect from the Bitcoin price in the last days of 2025. According to the on-chain expert, the market leader is likely to close the year in a sideways price range.

The relevant metric here is the Yearly Accumulated Negative Days, which tracks market resilience by measuring the number of days in a year where an asset’s daily price candlestick closed in the red.

According to historical data and patterns, Bitcoin typically witnesses an average of 170 days of negative price movement in a year. This mean figure or level provides insight into the stress threshold for the world’s largest cryptocurrency by market cap.

![]()

When the number of negative days is approaching or exceeds this threshold of 170 days, as Bitcoin already has in 2025, the selling pressure in the market tends to wane as fatigue sets in among the bears. Wedson revealed that the premier cryptocurrency has already accumulated 171 negative days so far in 2025.

The on-chain expert noted that exceeding this threshold “strongly suggests” that the price of Bitcoin might not witness any more negative days in the final few weeks of 2025. Wedson said that if a deeper correction is imminent for the market leader, it will most likely happen in the next year.

However, as the Alphractal founder highlighted, the Bitcoin price is more likely to end the year within a consolidation range. Adding further credence to this postulation is the lack of market demand, as seen with reduced capital influx into spot Bitcoin exchange-traded funds.

As of this writing, the price of BTC stands at around $89,397, reflecting a mere 0.3% drop in the past 24 hours.

![]()

According to the latest on-chain data, BitMine viewed the latest market downturn as an opportunity to further increase its exposure to Ethereum, the second-largest cryptocurrency by market cap. In two separate fresh buys, the Ethereum treasury firm expanded its holdings by over $199 million worth of Ether tokens.

In a recent post on the social media platform X, blockchain data firm Lookonchain revealed that BitMine acquired $199 million worth of Ethereum in the past two days. This fresh round of accumulation included two separate buys; 41,946 ETH equivalent to $130.78 million on Friday, December 5 and 22,676 ETH worth $68.67 million on Saturday, December 6.

This latest acquisition spree brings the Ethereum treasury firm’s holdings to around $11.3 billion, solidifying its position as the world’s largest corporate Ether holder. With its continued accumulation of the largest altcoin over the past few months, BitMine now holds about 3.08% of the total Ether supply.

It is worth noting that BitMine’s aggression in the market comes while the hype around digital asset treasuries (DATs) have died down. While crypto asset acquisitions have slowed down among treasury companies, shareholders are losing significant amounts in value—as the market downturn continues to also affect crypto-related stocks.

However, BitMine’s general performance has been quite impressive, with the firm announcing its intention to pay crypto’s first-ever dividend to shareholders. What’s interesting is that the Ethereum treasury firm sits on a cash reserve of nearly $900 million, which could go into additional ETH purchases.

BitMine’s continued accumulation of Ether is a proof of its faith in the token’s long-term promise. However, this aggressive purchasing activity has somewhat been opposite to what the market trend is suggesting.

The Ethereum price is hovering around the $3,000 mark after a mild correction from its recent local high around $3,200. According to on-chain data, mid-sized whales (holding between 1,000 and 10,000 ETH) have kept significant selling pressure on the market.

Meanwhile, Alphractal also revealed that the large whales (with over 10,000 ETH) have remained much more in a neutral and calm state, showing only light distribution.

Whales are typically regarded as some of the most influential investors in the market, as their moves often give insights on a coin’s trajectory. While BitMine counts as a whale—due to its significant holdings, it is interesting to see the firm move in the opposite direction of other relevant market participants.

![]()

![]()

BPCE will let millions of customers buy and sell BTC, ETH, SOL and USDC directly inside its banking apps.

![]()

South Korea plans to hold crypto exchanges to the same no-fault compensation standards as banks after an Upbit hack exposed major gaps in consumer protection.